Here’s something most homeowners don’t check nearly as often as they should: the real value of their home.

Why does it matter? Because your house probably isn’t just where you sleep at night — it’s your biggest financial asset. And while you’ve been busy living life, your home has likely been building wealth for you in the background. Quietly. Consistently. Almost like a savings account you forgot you had.

What’s That Hidden Wealth Called?

It’s called equity — the difference between what your home is worth today and what you still owe on your mortgage. And here’s the kicker: according to Cotality, the average U.S. homeowner with a mortgage has about $302,000 in equity right now.

That’s six figures just sitting there.

Why Your Equity Might Be Bigger Than You Think

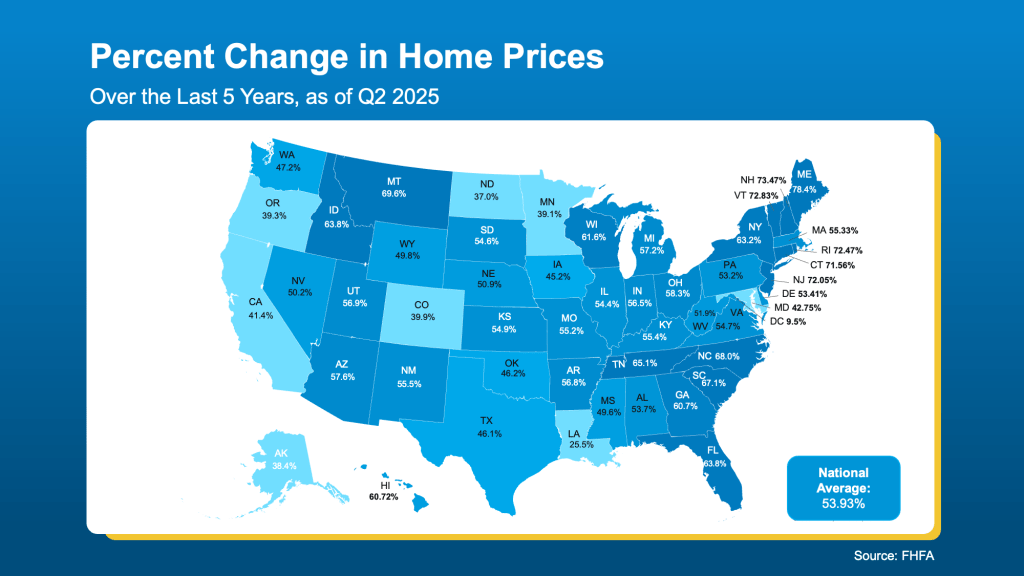

- Home Prices Exploded. Over the last five years, home values jumped nearly 54% nationwide (FHFA). Even if prices have cooled a bit in your area recently, the long game has been in your favor.

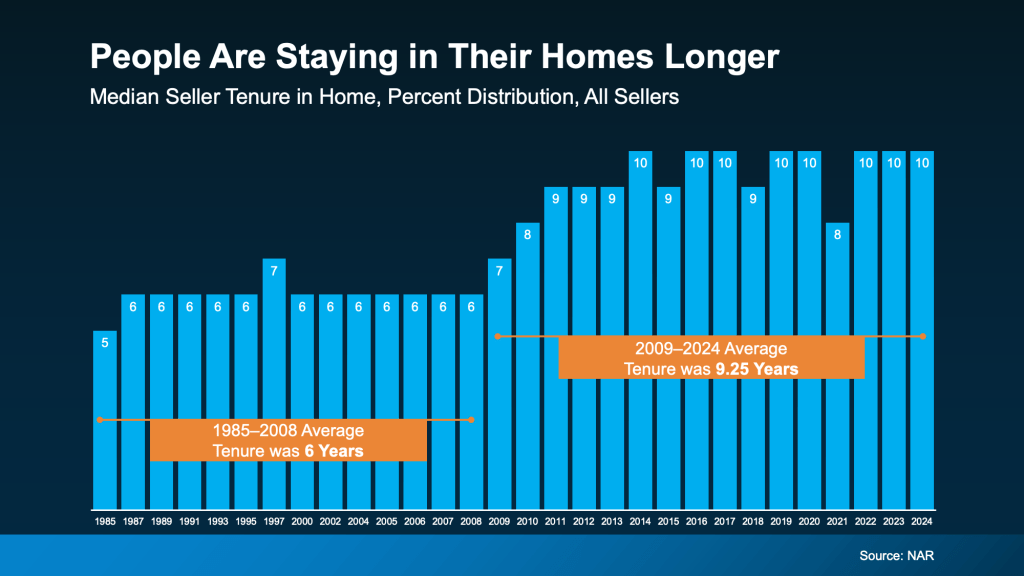

- People Are Staying Put Longer. The average homeowner now stays in their house about 10 years (NAR). That’s a whole decade of mortgage paydowns plus appreciation stacking up for you.

Put those two factors together and here’s the result: according to NAR, the typical homeowner gained over $200K in wealth just from price appreciation in the past decade.

So, What Can You Actually Do with All That Equity?

- Upgrade Your Lifestyle. Roll it into a down payment (or even buy your next place in cash).

- Reimagine Your Space. Renovate your current home and make it work better for your life today.

- Fuel Your Dreams. Tap into it for startup costs or investments that could build even more wealth.

Bottom Line

Your home isn’t just where you live — it’s a wealth-building machine. If you haven’t checked your equity lately, you might be sitting on way more than you think. Let’s run the numbers together so you can see exactly how much hidden wealth your home is holding.