You may have noticed headlines warning that foreclosures are on the rise. If that made your heart skip a beat, wondering whether we’re headed for another housing crash, let’s take a closer look.

First, some perspective: during the housing crisis between 2007 and 2011, over nine million people went through some form of distressed sale. Last year? Just over 300,000. So yes, foreclosures are ticking up slightly—but we’re still far from the numbers we saw during the crash.

So, is a wave of foreclosures looming? The short answer: no.

Why Mortgage Delinquencies Matter

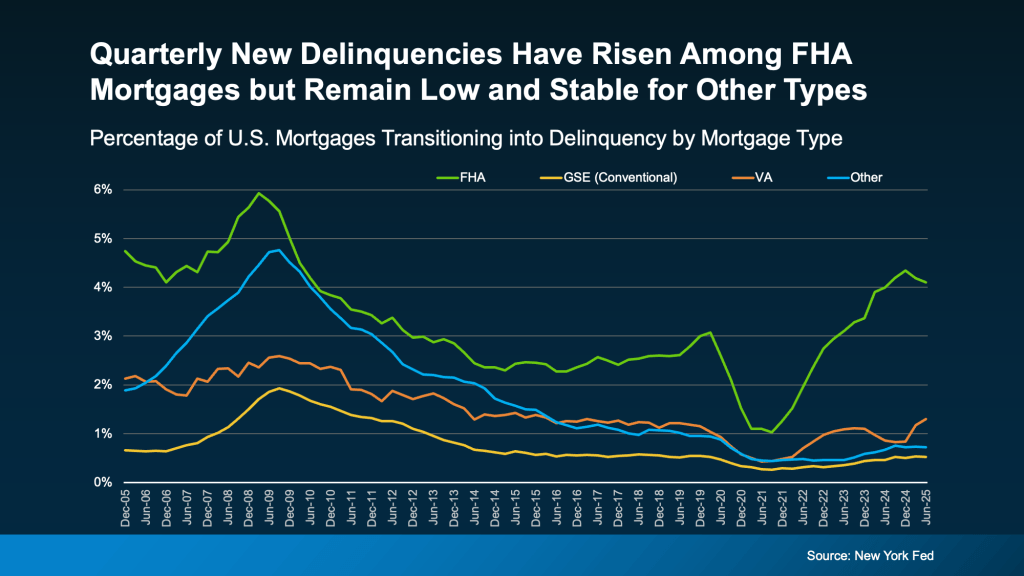

Experts track mortgage delinquencies—loans that are more than 30 days past due—as an early warning for potential foreclosures. And right now, the data is actually encouraging.

Overall delinquency rates are holding steady compared to last year, which suggests we’re not seeing the kinds of spikes that typically precede a market-wide crisis.

That said, there are some shifts worth noting. Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association, points out:

“While overall mortgage delinquencies are relatively flat compared to last year, the composition has changed.”

Specifically, borrowers with FHA loans currently make up the largest share of new delinquencies. Why? FHA borrowers tend to be more sensitive to economic changes. With inflation, employment concerns, and ongoing recession worries, it’s understandable that this group is feeling some pressure.

But here’s the key takeaway: delinquency rates for conventional and other loan types remain low and stable. Back in 2008, every loan type was struggling—and that’s not the case today.

A Closer Look at FHA Loans

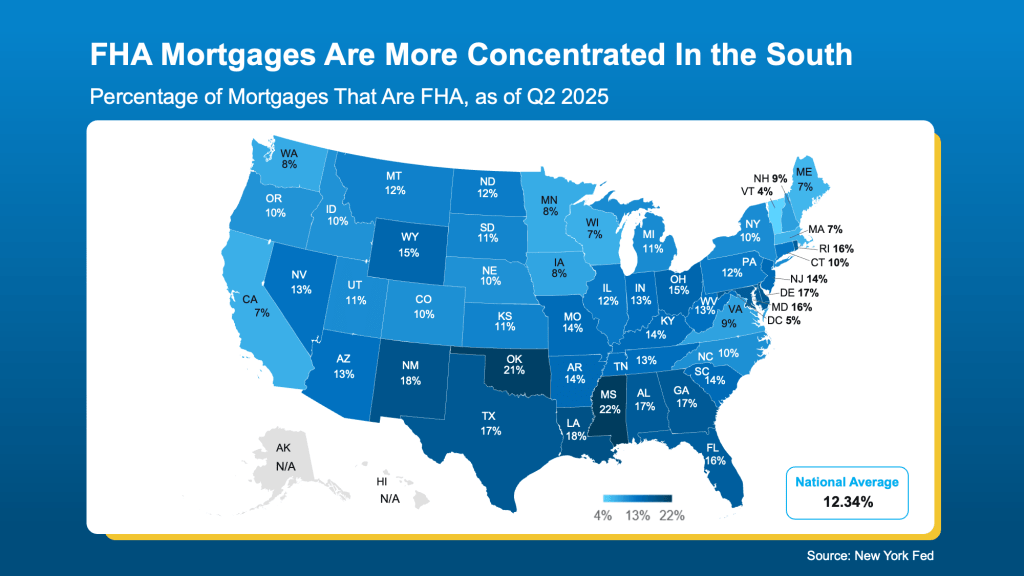

FHA loans account for only about 12% of all home loans nationwide, so even the uptick in delinquencies here doesn’t spell disaster. There are regions—particularly in the South—where FHA loans are more common, which can make localized delinquencies seem higher.

As the Federal Reserve Bank of New York notes:

“Higher delinquency rates often coincide with a higher share of FHA loans across states.”

Even in those areas, though, delinquencies are nowhere near the levels seen in 2008.

What Homeowners Need to Know

If you’re a homeowner struggling with payments, you’re not alone—and there are options. Start by talking to your mortgage lender. Many homeowners can set up repayment plans or explore loan modifications.

Plus, today’s homeowners often have significant equity in their homes, giving you more options than in previous downturns. Selling your home to avoid foreclosure may be a possibility—and for many, it’s a realistic route.

Bottom Line

Yes, foreclosures are up slightly—but the numbers aren’t alarming. Mortgage delinquency trends don’t suggest a crash is coming.

Experts will continue to monitor the market, and staying informed is key. If you want real-time updates and guidance on navigating the housing market, let’s connect so you always have the latest insights.