You’ve probably asked yourself lately: Is it even worth trying to buy a home right now?

With high home prices and mortgage rates that refuse to budge, renting can feel like the safer, more affordable option. In some cases, it might even be your only realistic choice in the moment. That’s completely valid. Buying a home isn’t right for everyone right away. You should only move forward when you’re financially and emotionally ready.

But here’s what many overlook: renting may feel easier today, but it often comes with significant long-term costs.

Renting Might Feel Simpler, But…

A recent Bank of America survey found that 70% of aspiring homeowners are concerned about the long-term financial implications of renting. And for good reason.

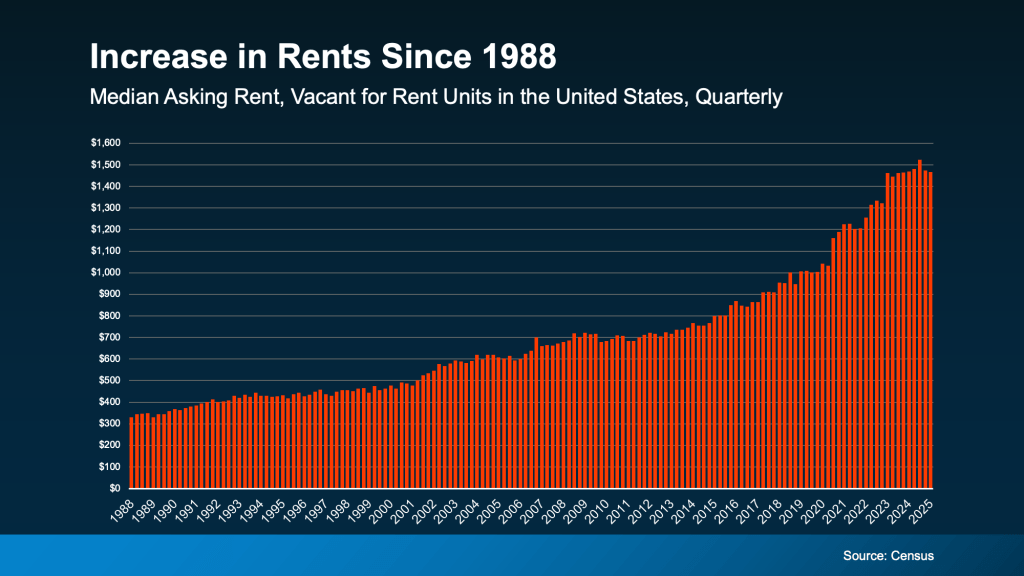

When you rent, your monthly payment covers a place to live—but that money doesn’t come back to you. It builds no equity and creates no return. You’re helping your landlord build wealth, not yourself. Home prices and rents have both risen dramatically over the past few decades, but the difference is that homeowners typically benefit from these increases through rising equity, while renters continue to pay more without gaining anything in return.

Why Homeownership Still Matters

Owning a home isn’t just about having a roof over your head. It’s one of the most effective ways to build long-term financial stability and wealth.

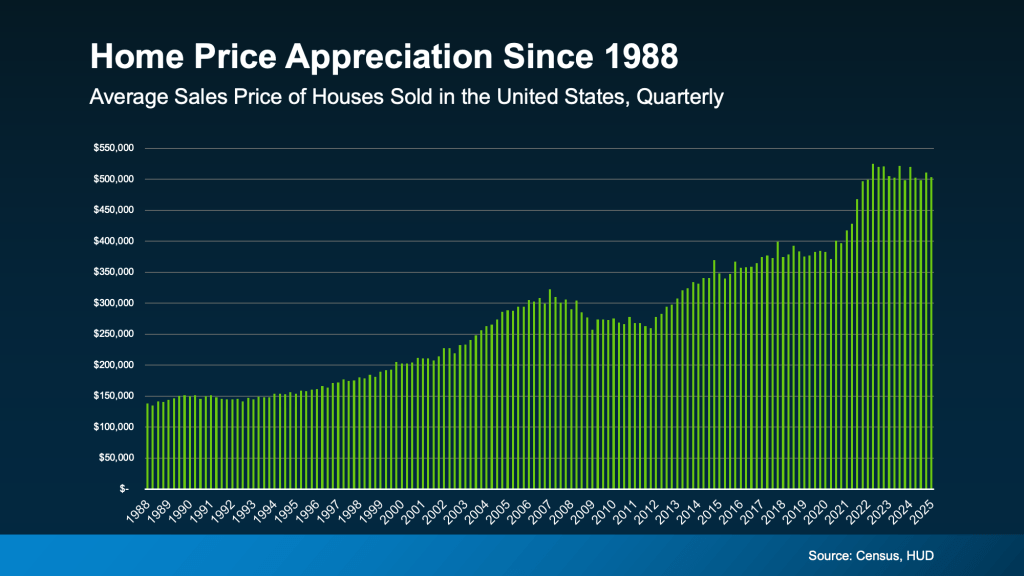

Historically, home prices have appreciated over time. This means the longer you wait to buy, the more expensive it could become. Even in markets where prices are currently stabilizing, the long-term trend is upward.

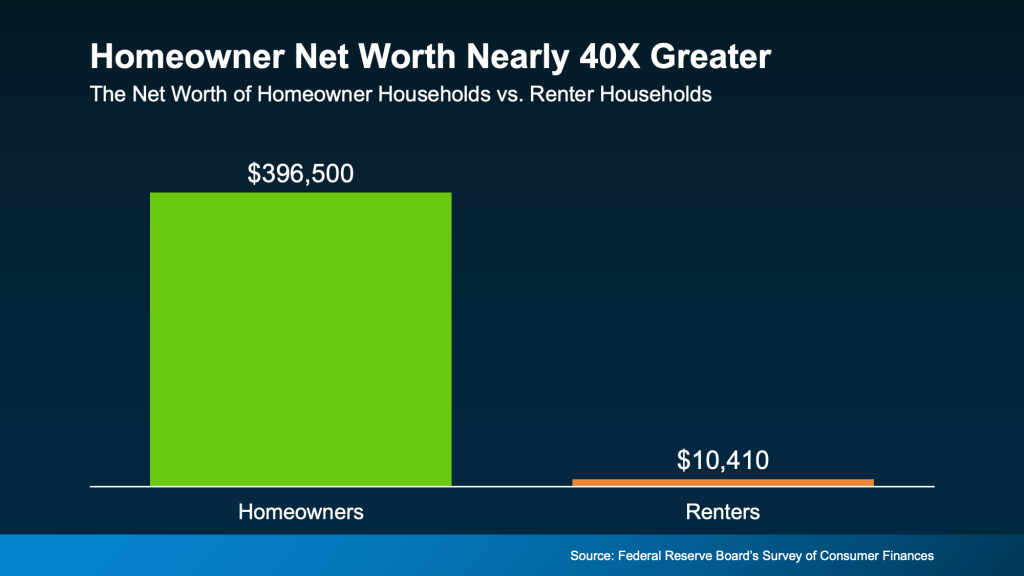

Each mortgage payment you make as a homeowner builds equity—the difference between your home’s value and what you owe. That equity grows with time and becomes part of your net worth. In fact, the average homeowner’s net worth today is nearly 40 times greater than that of a renter.

The Biggest Downside of Renting

While renting can offer lower upfront costs, fewer responsibilities, and more flexibility, it comes with a major drawback: it doesn’t build wealth.

Rents have steadily increased over the years, and while you might enjoy short-term savings compared to a mortgage, those savings are short-lived. In the long run, renting can make it harder to set aside money for a down payment—and delay your path to ownership.

According to the same Bank of America survey, 72% of renters say rising rent is negatively impacting both their current finances and their ability to plan for the future.

Renting vs. Buying: It Comes Down to Strategy

The truth is, both renting and buying come with trade-offs. Renting may give you breathing room today, but buying builds something for tomorrow. Think of it this way: renting is like paying into someone else’s savings account, while owning is like contributing to your own.

Of course, homeownership also comes with responsibility. But for many, the long-term financial and emotional benefits make those challenges worthwhile.

As Joel Berner, Senior Economist at Realtor.com, puts it: “Households working on their budget will find it much easier to continue to rent than to go through the expenses of homeownership. However, they need to consider the equity and generational wealth they can build up by owning a home that they can’t by renting it.”

Bottom Line

Renting might be the right choice for your current situation. But don’t let it become your only plan.

If homeownership feels out of reach, the first step is to create a strategy. A clear plan, tailored to your financial goals and timeline, can help you move toward owning a home—on your terms.

Let’s connect and talk about your goals. Whether you’re ready now or just starting to explore the idea, there’s a path forward.