If you’ve owned your home for a while, chances are you’ve built up some serious equity—just by living there and riding the wave of rising home values. And that equity? It might hold more than just financial weight. It could open the door to homeownership for your children.

Let’s face it: today’s housing market is tough on first-time buyers. Even those with good jobs and responsible habits are struggling to break into the market. High prices and steep down payments can make the dream of owning a home feel more like a fantasy. But as a homeowner, you may have the power to change that narrative.

Recent data shows the average U.S. homeowner with a mortgage is sitting on around $311,000 in equity (source: Cotality, formerly CoreLogic). That’s a significant financial cushion—and some parents are tapping into that equity to give their children a meaningful leg up.

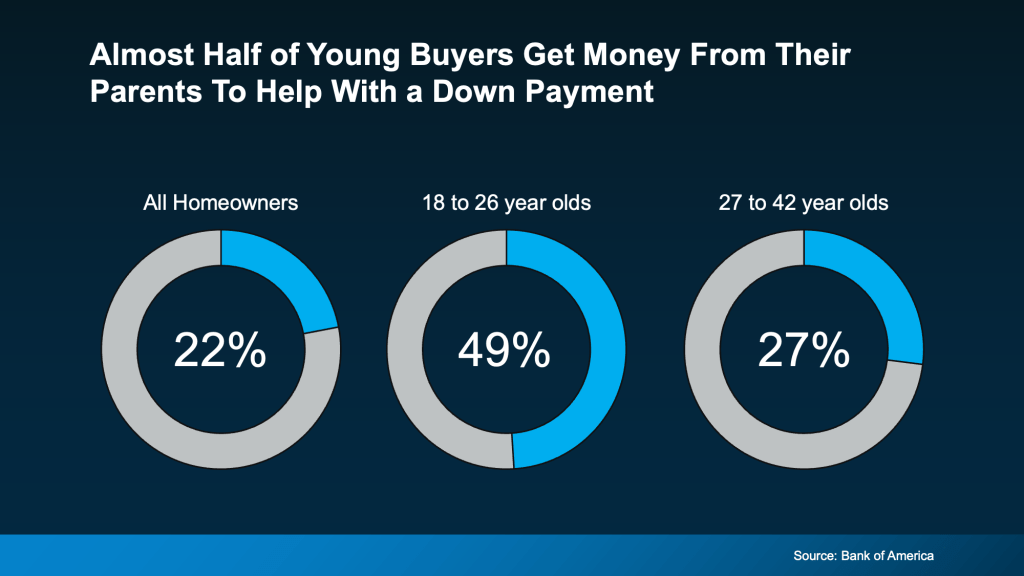

In fact, Bank of America reports that nearly half (49%) of Gen Z buyers (ages 18–26) received financial help from their parents for a down payment. While not all of those funds came directly from home equity, there’s a good chance many of them did—especially given how much wealth homeowners have built in recent years.

Using your equity to help your child buy a home isn’t just a generous gesture—it’s a strategic one. It allows your child to start building equity of their own sooner, giving them a stronger financial foundation and a sense of stability in a world that often feels uncertain.

And it’s more than just a financial transaction. It’s a gift that says, “I believe in you, and I want to help you create a future.” For many parents, being part of that “we got the house” moment is worth more than any number on a balance sheet.

To put it in perspective: a Compare the Market study found that 45% of Americans who received help from parents or grandparents wouldn’t have been able to buy a home without it. That’s nearly half of young buyers who wouldn’t be homeowners today without that support.

The Takeaway

Your home equity isn’t just a number—it’s an opportunity. If the idea of helping your kids buy a home feels overwhelming or out of reach, it might be more doable than you think. Start by having a conversation with your lender or a trusted financial advisor to explore the possibilities.

Because sometimes, the greatest return on your investment isn’t just in property—it’s in people.