If you’re feeling like your student loan debt is keeping you from buying a home, you’re definitely not alone. In fact, a recent study found that 72% of people with student loans believe their debt is delaying their path to homeownership.

Maybe you’re wondering:

- Do I need to pay off my student loans before I can buy a house?

- Can I even qualify for a mortgage with this debt?

These are totally normal questions—especially when you’re thinking about making one of the biggest financial moves of your life. But here’s the good news: you might not need to hit “pause” on your homeownership dreams after all.

Buying a Home with Student Loans: Is It Possible?

Short answer: yes.

According to Yahoo Finance, “Student loans don’t have to get in your way when it comes to becoming a homeowner.” It really comes down to understanding how your debt factors into your overall financial picture—and taking the right steps to prepare.

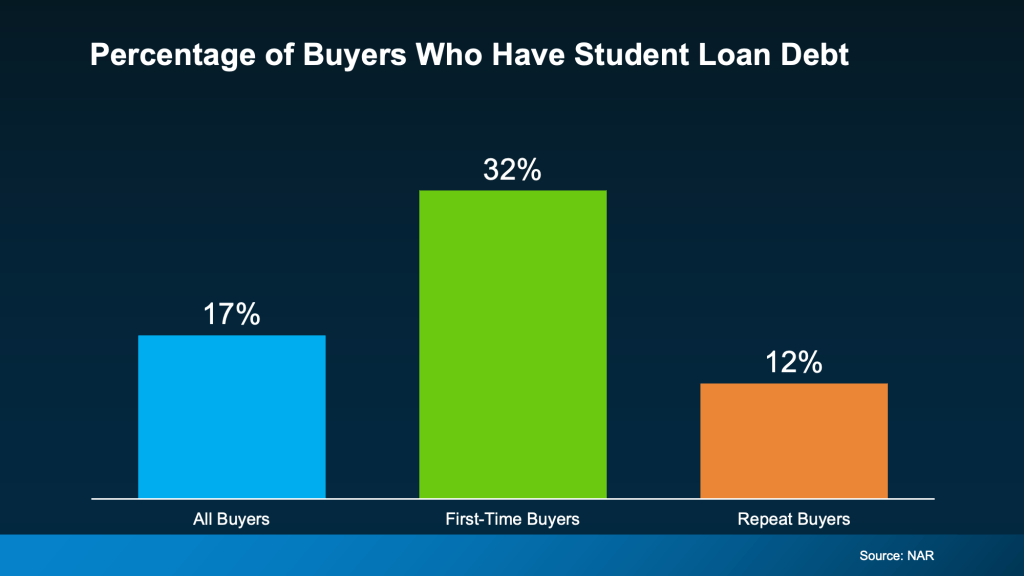

The National Association of Realtors reports that nearly one-third (32%) of first-time homebuyers had student loan debt. So you’re in good company. The typical amount owed? Around $30,000. Yet many still managed to purchase their first home.

As Chase points out, student loans generally affect your mortgage eligibility the same way other debts—like car payments or credit cards—do. It’s all about your income, your credit, and your debt-to-income ratio.

If your finances are in decent shape and your income is stable, having student loans doesn’t automatically disqualify you from getting approved for a mortgage.

Bottom Line

Student loans don’t have to be a dealbreaker. Before you assume you need to wait, consider speaking with a lender. They can help you understand your options and give you a clearer sense of how close you might be to buying your first home.

You may be more ready than you think.