With all the talk about a possible recession, it’s natural to wonder how it might impact the housing market. Recessions often come with a lot of uncertainty, and people start worrying about home prices and mortgage rates. But history can offer some insight into what might happen. Let’s break it down.

Recession Doesn’t Always Mean Home Prices Will Drop

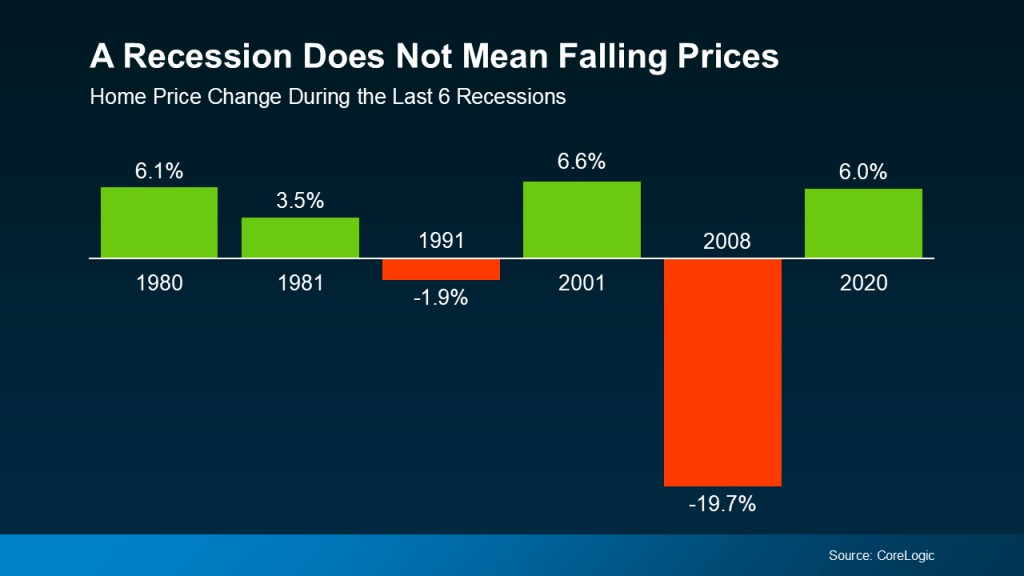

One common misconception is that a recession always leads to falling home prices. We all remember the 2008 housing crisis, where prices plummeted. But that was a rare exception, driven by specific factors like subprime lending and a housing bubble. In fact, looking at past recessions, home prices haven’t always dropped. In four of the last six recessions, home prices actually increased. During these times, the market has been influenced by factors like low inventory, strong demand, and long-term trends that help stabilize prices even during economic slowdowns.

What does that mean for today? If you’re thinking about buying or selling, don’t assume a recession will lead to a crash in home prices. While things might slow down a bit, it’s more likely that prices will continue to follow their current trajectory—moderate growth or stability. Nationally, prices are still rising at a more normal pace, not the extreme growth we saw during the pandemic boom.

Mortgage Rates Typically Decline During Recessions

Another thing to consider is mortgage rates. During past recessions, mortgage rates have typically fallen, making it more affordable for buyers to get into homes. When the economy slows down, the Federal Reserve often lowers interest rates to stimulate growth, which in turn can push mortgage rates down as well. This could help ease the cost of borrowing, making homeownership more accessible, especially for those who might be on the fence about buying.

That being said, while lower rates may seem like a good deal, don’t expect the super-low 3% mortgage rates we saw in recent years. Those were a result of a very unique economic situation, and we’re unlikely to see rates that low again anytime soon. However, if the economy weakens, we could still see rates drop from where they are now, which would provide some relief to buyers looking for a more affordable monthly payment.

The Bigger Picture

At the end of the day, a recession doesn’t mean disaster for the housing market. While it can cause some shifts, the long-term trends of supply, demand, and interest rates are more important in determining the health of the market. Historically, recessions tend to have a short-term impact on home prices, and more often than not, housing has proven to be a stable investment over time.

That being said, it’s important to stay informed. The economic environment is always evolving, and each recession is a little different. The key is to think about your own goals and circumstances. If you’re looking to buy, the potential for lower mortgage rates could be a silver lining, but it’s essential to make decisions based on your personal situation, not just market conditions.

If you’re unsure about how a possible recession might affect your decision to buy or sell, feel free to reach out. I’m happy to help break it down and give you a clearer picture of what might be best for you in this evolving market.