If retirement is coming up soon, it’s time to start thinking about what’s next. You want to enjoy this new chapter without financial stress, right? Well, what if I told you that you might be sitting on a hidden source of wealth? Yep, it’s your home!

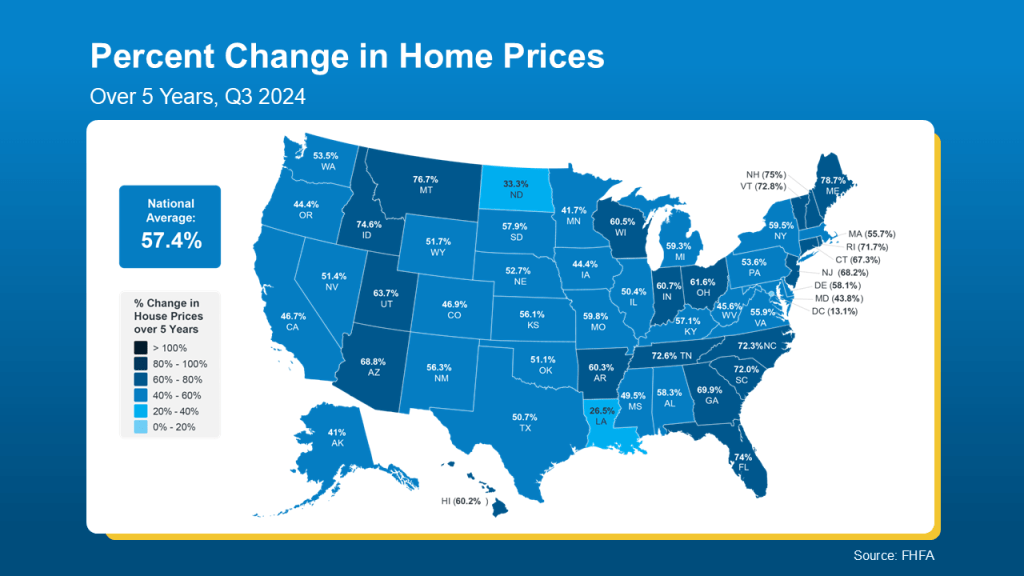

Over the last five years, home values have shot up nearly 60%, according to the Federal Housing Finance Agency (FHFA). That kind of appreciation means homeowners—especially those who’ve owned their homes for a while—have built up a significant amount of equity. In fact, Freddie Mac reports that Boomers have gained an average of $486,000 in wealth, with about half of that coming from rising home prices.

So, what does that mean for you? If you’re looking for ways to make the most of your retirement, tapping into that equity by selling and downsizing could be a game-changer.

Why Downsizing Could Be a Smart Move

Selling your home and moving into a smaller place—or relocating to a more budget-friendly area—could free up a chunk of your equity, giving you extra financial security for the years ahead. Whether you want to travel, spend time with family, or just feel more comfortable with your finances, selling your home could be the key to making it happen. As Chase Bank puts it:

“Retirement is an exciting time. Selling your home to take advantage of the equity or to downsize to a more affordable home can open up additional options for your future.”

Here’s how downsizing can benefit you:

- Lower Your Monthly Expenses – According to AARP, the #1 reason adults 50+ move is to cut down on living costs. A smaller home or a move to a more affordable area can mean lower mortgage payments, property taxes, utilities, and maintenance costs—leaving you with more money for the things you love.

- Make Life Simpler – A smaller space usually means less maintenance and fewer responsibilities. That means more free time to focus on hobbies, travel, or just relaxing and enjoying life without the constant upkeep of a big house.

- Gain Financial Flexibility – Selling your current home gives you access to the wealth you’ve built up over the years. You can use that equity however you want—whether it’s investing, paying off debt, or creating a financial cushion for peace of mind.

What’s the Next Step?

If downsizing sounds like a smart move, the first thing you’ll want to do is connect with a real estate agent. They’ll help you figure out how much equity you have, explore your options, and guide you through the process of selling your home and finding a new one that fits your retirement goals.

The Bottom Line

If you’re planning to retire in 2025, now is a great time to start thinking about downsizing and making the most of your home equity. Let’s start planning now so you can step into retirement with confidence—and make every day feel like a Saturday!