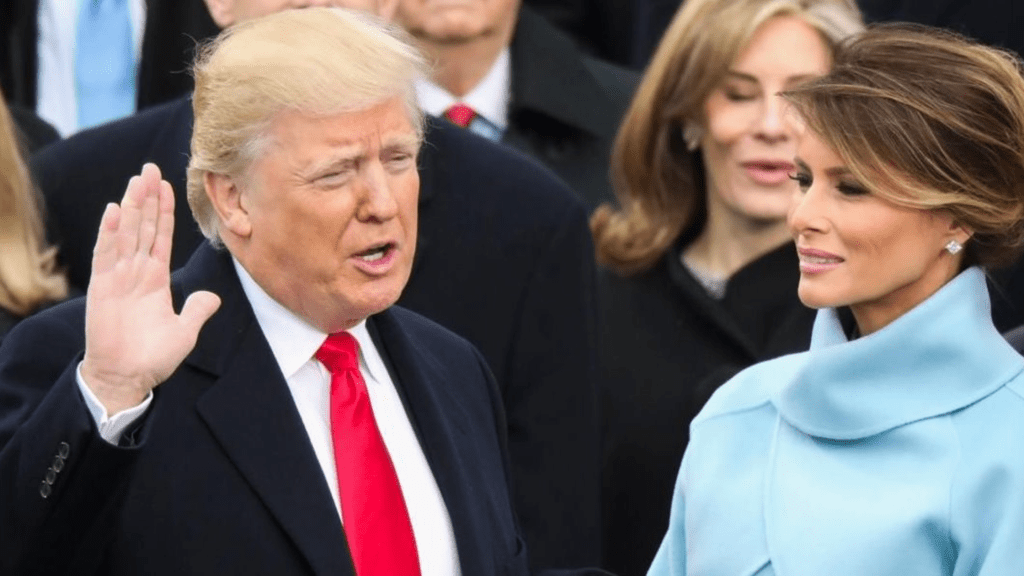

The inauguration of Donald Trump as the 47th President of the United States on January 20, 2025, marks a significant political shift that could influence various aspects of the economy, including the real estate market. Whether you’re a homeowner, investor, or potential buyer, understanding the potential impact of this leadership transition is crucial.

- Economic Confidence and Real Estate Investment

Presidential transitions often affect consumer and investor confidence, which can ripple through the housing market. Trump’s policies during his first term focused on tax cuts and deregulation, which contributed to economic growth and a thriving stock market. If similar policies are pursued in his second term, we could see renewed investor confidence that may lead to increased activity in the luxury real estate market and commercial property investments.

- Potential Tax Policy Changes

During his first term, Trump’s Tax Cuts and Jobs Act of 2017 had a profound impact on the real estate market, particularly by limiting state and local tax (SALT) deductions. This policy disproportionately affected homeowners in high-tax states, shifting demand to lower-tax states. If Trump pursues further tax reforms, homeowners and buyers should watch for changes that might affect deductions, capital gains taxes, or incentives for real estate investment.

- Interest Rates and Housing Affordability

Trump’s second term begins amidst a period of rising interest rates, a trend that has already strained housing affordability. While the Federal Reserve operates independently of the presidency, the administration’s fiscal policies can influence inflation and, by extension, interest rates. If Trump’s policies lead to reduced inflation, this could stabilize or lower interest rates, providing relief to buyers and making homeownership more accessible.

- Regulatory Changes

One of Trump’s hallmarks as president was reducing regulations across industries. In real estate, deregulation could streamline zoning laws and development approvals, encouraging more construction and potentially easing housing supply shortages. However, reduced regulations might also raise concerns about environmental sustainability and urban planning.

- Migration Patterns and Housing Demand

Political climates often drive migration patterns, with individuals and businesses relocating to states that align with their economic and social values. Trump’s policies on taxes, immigration, and business incentives could accelerate moves to states like Florida and Texas, which are already experiencing population booms. This increased demand could drive up home prices in these areas while creating opportunities for sellers.

- Luxury Market Impacts

Trump’s background in luxury real estate development often correlates with policies that benefit high-net-worth individuals. This could lead to growth in the luxury real estate market, both domestically and internationally. Cities like Miami, New York, and Los Angeles may see increased activity in high-end property sales as affluent buyers capitalize on favorable conditions.

- Infrastructure Investments

During his inaugural address, Trump hinted at plans for significant infrastructure investments. Modernizing infrastructure could boost real estate values in areas undergoing development, particularly in rural and suburban communities. Improved transportation, utilities, and public amenities can make these areas more attractive to buyers and investors.

What It Means for Buyers, Sellers, and Investors

For Buyers: Stay informed about interest rate trends and potential tax changes that could impact your purchasing power.

For Sellers: Be prepared to adjust pricing strategies based on local demand shifts and economic conditions.

For Investors: Keep an eye on migration trends and regulatory changes that could create new opportunities in emerging markets.

Conclusion

The inauguration of Donald Trump in 2025 introduces a new era of policy changes that will undoubtedly influence the real estate market. While it’s too early to predict the full scope of these impacts, staying informed and working with knowledgeable professionals will help you navigate this evolving landscape. Whether you’re buying, selling, or investing, the key is to adapt to the changes and seize opportunities as they arise.