If you’re looking at today’s mortgage rates and home prices and feeling a little unsure about whether it’s still a good time to buy a home, you’re not alone. While it’s true that market factors are important, there’s a bigger picture to consider: the long-term perks of owning a home.

Think about it—if you know people who bought homes 5, 10, or even 30 years ago, it’s pretty rare to hear someone regret their decision. That’s because, over time, home values generally rise. And when your home increases in value, so does your net worth. Let’s break down how that really adds up over the years.

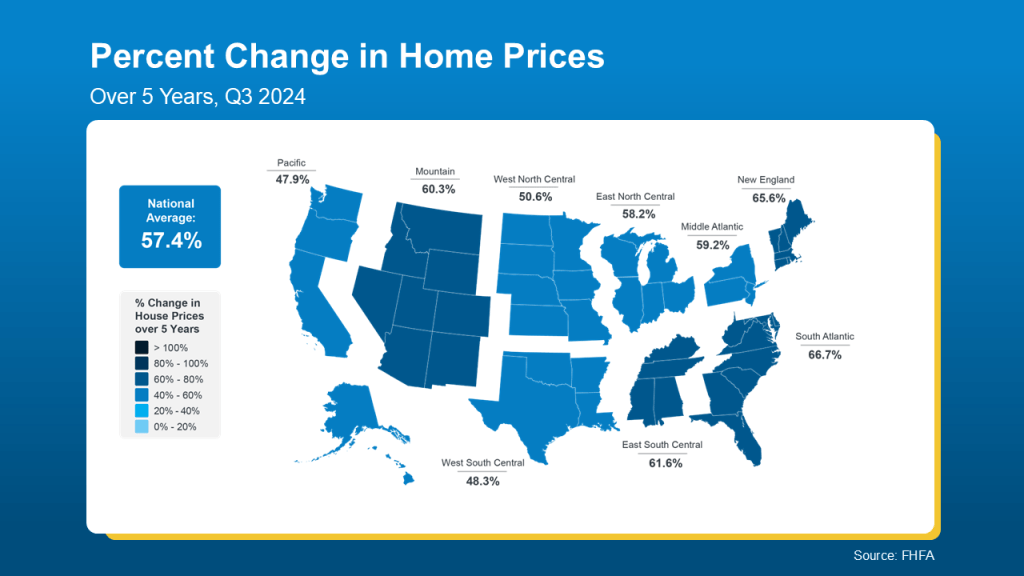

Home Prices Over Time

The map below shows how home prices have grown over the past five years, based on data from the Federal Housing Finance Agency (FHFA). Since prices vary by location, the map breaks things down region by region to give you a better idea of the overall market trends:

As you can see, nationally, home prices jumped more than 57% in just five years. Some areas saw a little more growth, while others saw slightly less, but across the board, home prices have gone up significantly in a relatively short time. And when we look at an even longer timeframe, the picture gets even clearer (check out the map below):

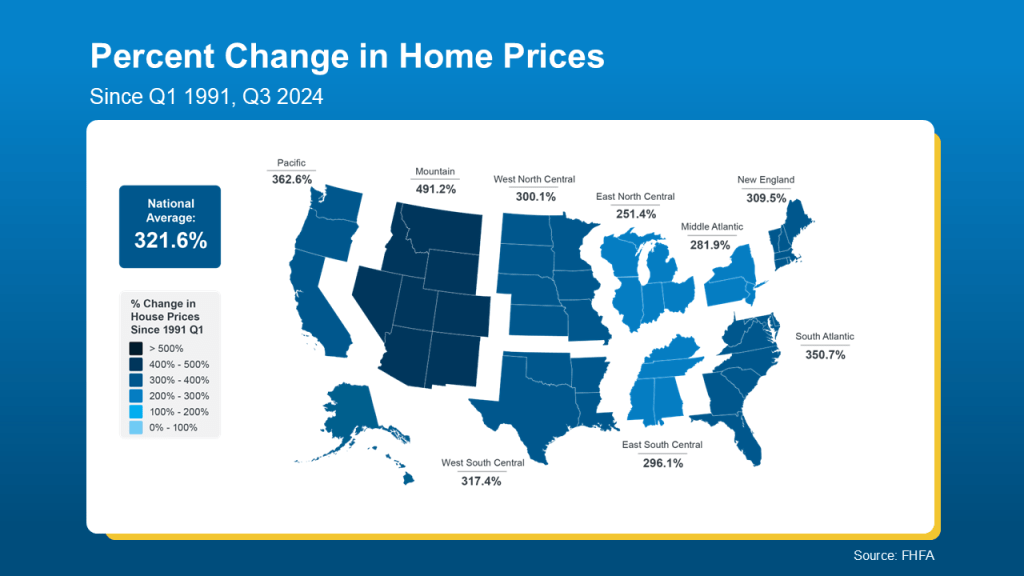

The second map shows that, over the last 30 years, home prices increased by more than 320% on average. This means that someone who bought a home 30 years ago probably saw their property value more than triple during that time—and that’s a huge reason so many people who bought years ago are still glad they did.

Bottom Line

Sure, today’s market is a bit tricky, but if you’re in a position to buy, it’s still worth considering the long-term benefits. Let’s chat about how we can make your home purchase happen so you can start building wealth as your home value rises over time!