Thinking about buying or selling a home? Then you’ve probably been keeping an eye on mortgage rates. It’s no surprise since they have a big impact on how much you’ll pay each month. Here’s a quick rundown on what you need to know.

What’s Going On with Mortgage Rates?

Lately, mortgage rates have been trending down, which is great news if you’re house-hunting. But remember, rates can be unpredictable. They’re influenced by a bunch of factors like the economy, inflation, the job market, and decisions made by the Federal Reserve.

As Odeta Kushi, Deputy Chief Economist at First American, puts it:

“Lower mortgage rates could be on the horizon, but the journey towards them might be slow and bumpy.”

So while rates might drop, don’t be surprised if they fluctuate along the way.

What Does This Mean for You?

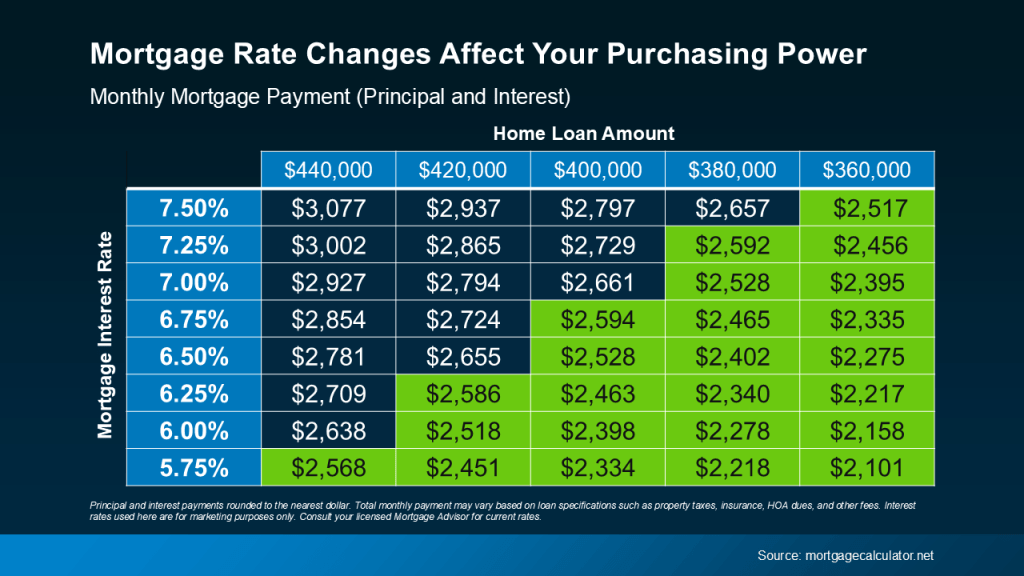

Even small changes in mortgage rates can make a big difference in your monthly payment. For example, if you’re budgeting around $2,600 a month for a mortgage, the rate will determine how much house you can afford. Understanding how rates affect your payment can really help you plan smarter.

How Do You Stay on Top of Mortgage Rates?

You don’t need to be a mortgage expert to figure this out—that’s what real estate agents are for! They can break down what’s happening and show you how rate changes affect your buying power with helpful tools like charts and visuals.

Bottom Line

Got questions about mortgage rates or the housing market? Let’s chat! I’ll help you stay in the loop and make sense of everything so you can make the best decision for you.