Retirement is your time to kick back, explore new hobbies, and soak up all those joys you’ve been dreaming about. But before you dive into this awesome new chapter, have you thought about whether your current home is still up to snuff?

If your house is feeling a bit too spacious, pricey, or just a hassle to manage, downsizing might be the ticket to making your retirement smoother and more enjoyable. So, how do you know if a smaller place is the way to go? Ask yourself these questions:

- Are the reasons I bought this house still valid, or have my needs changed?

- Do I actually need all this space, or would a cozier spot be better?

- What am I spending on my home now, and how much could I save by moving to something smaller?

If you’re nodding along to any of these, downsizing could be your golden ticket. Here’s why:

The Perks of Moving to a Smaller Home

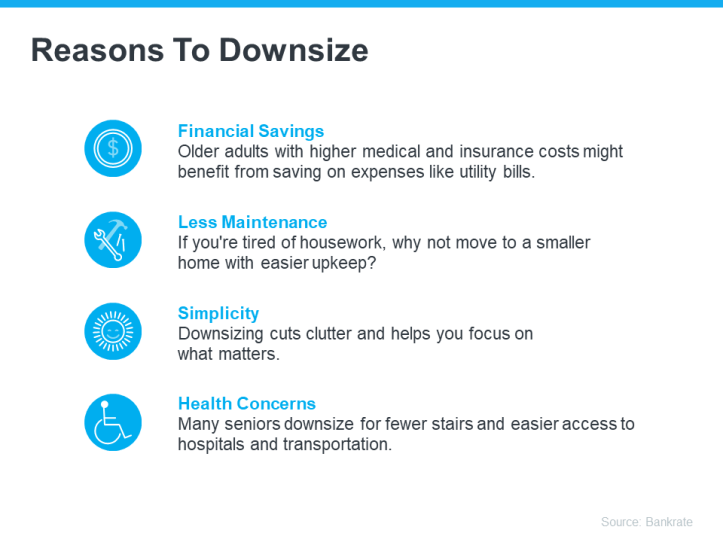

Downsizing has its perks, and they’re pretty sweet. Here’s a snapshot from Bankrate:

Cash in on Your Equity: If you’ve been in your home for a while, you probably have some decent equity built up. And guess what? You can use that to help fund your next home. As Seniors Guide points out, “Homeowners aged 62 and older have more than $12 trillion in home equity.” That’s a lot of potential!

Lower Monthly Expenses: Greg McBride from Bankrate explains that selling your current home and using the equity can help you buy a new place outright or make a big down payment, which means lower monthly costs.

When you’re ready to make the move, your real estate agent will be your go-to person for everything—from pricing your current home to finding one that fits your new lifestyle, all while keeping an eye on today’s mortgage rates.

The Bottom Line

Ready to kick off your retirement with a fresh start? Downsizing might just be the best move you can make. When you’re set to explore this option, let’s chat and get things rolling!