Remember the 2008 housing crisis? It was a game-changer, impacting countless lives, even if you weren’t in the housing market at the time. But today’s housing landscape looks vastly different, and here’s why you can breathe easier this time around.

According to experts cited by Business Insider, the consensus among economists studying the housing market is clear: we’re not headed for a crash in 2024. Unlike the conditions that led to the 2008 crisis, today’s market fundamentals are more stable.

One of the key indicators is housing inventory. For a market crash to happen, there typically needs to be an oversupply of homes for sale. Back in 2008, we saw a flood of properties hitting the market, driving prices down rapidly. This time, however, the situation is reversed – there’s actually a shortage of homes available for sale. This undersupply persists despite some growth in inventory this year.

Let’s break down the sources of this inventory:

Existing Homes: While there has been an increase in the number of existing homes for sale compared to last year, nationally, it still falls far below the levels seen during the crash. The current supply is depicted in the graph below (green), contrasting sharply with the peak inventory of 2008 (red).

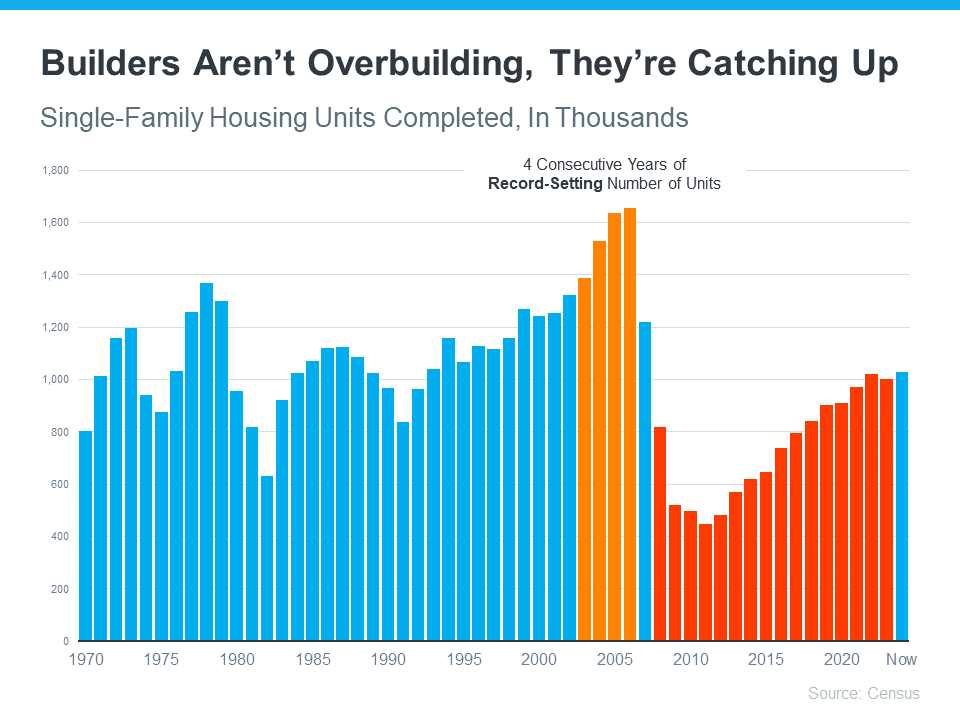

New Construction: Concerns about overbuilding are also unfounded. Builders have been cautious since the Great Recession, which means they haven’t flooded the market with new homes. In fact, there’s a notable shortage of new construction homes available for purchase, as illustrated by data from recent years.

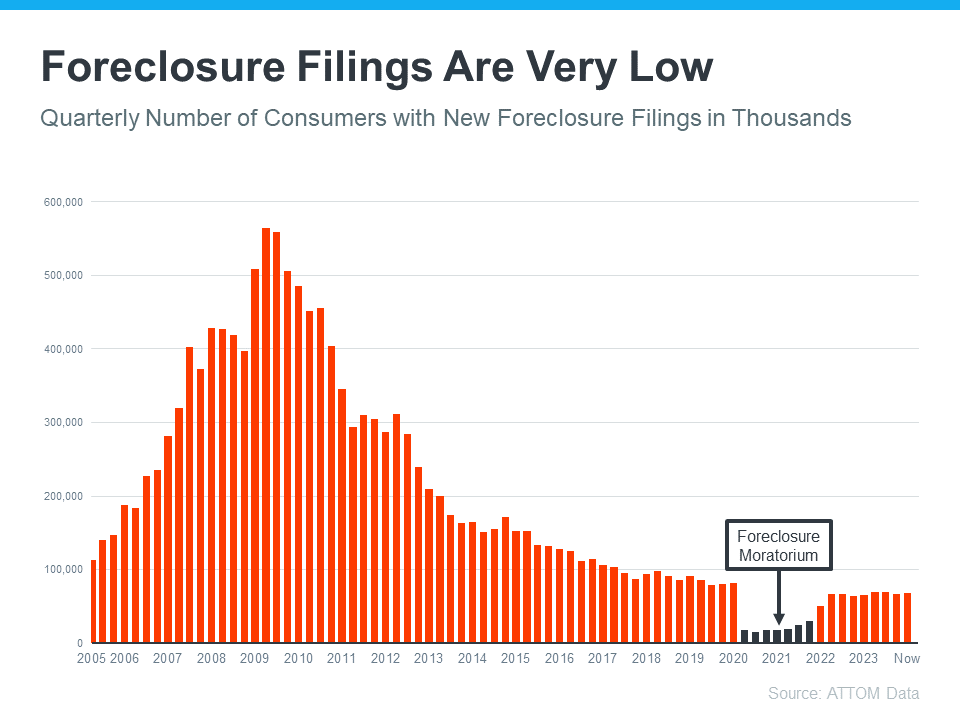

Distressed Properties: Another factor that triggered the 2008 crisis was the high number of distressed properties, including foreclosures and short sales. Today, stricter lending standards have resulted in fewer homeowners defaulting on their mortgages, thereby reducing the supply of distressed properties hitting the market.

What does all this mean for the average homeowner or prospective buyer? It means that while home prices may continue to rise due to strong demand and limited supply, the risk of a sudden crash like in 2008 is minimal. Experts like Mark Fleming and Lawrence Yun emphasize that the current imbalance between supply and demand is supportive of stable prices, rather than a collapse.

Looking ahead, the housing market in 2024 appears to be on solid ground. While some may worry about a housing bubble, the consensus among industry professionals is that the market dynamics today are fundamentally different. Tight supply conditions coupled with strong demand suggest that any price adjustments are likely to be gradual and reflective of economic conditions rather than a systemic collapse.

So, whether you’re a homeowner or thinking about buying, rest assured that the conditions driving today’s housing market are not indicative of a repeat of the past.