Hey there, homeowners! If you’ve been living in your own house for the past year, your net worth has likely seen a nice boost. Home prices have been on the rise, which means you’re building up equity faster than you might realize. Let’s break it down.

What’s Equity?

Equity is simply the current value of your home minus what you owe on your mortgage.

Why the Increase?

Over the past year, the demand for homes has outpaced the supply, pushing prices higher. This rise in home prices has translated directly into increased equity for homeowners like you.

How Much Equity Have You Gained?

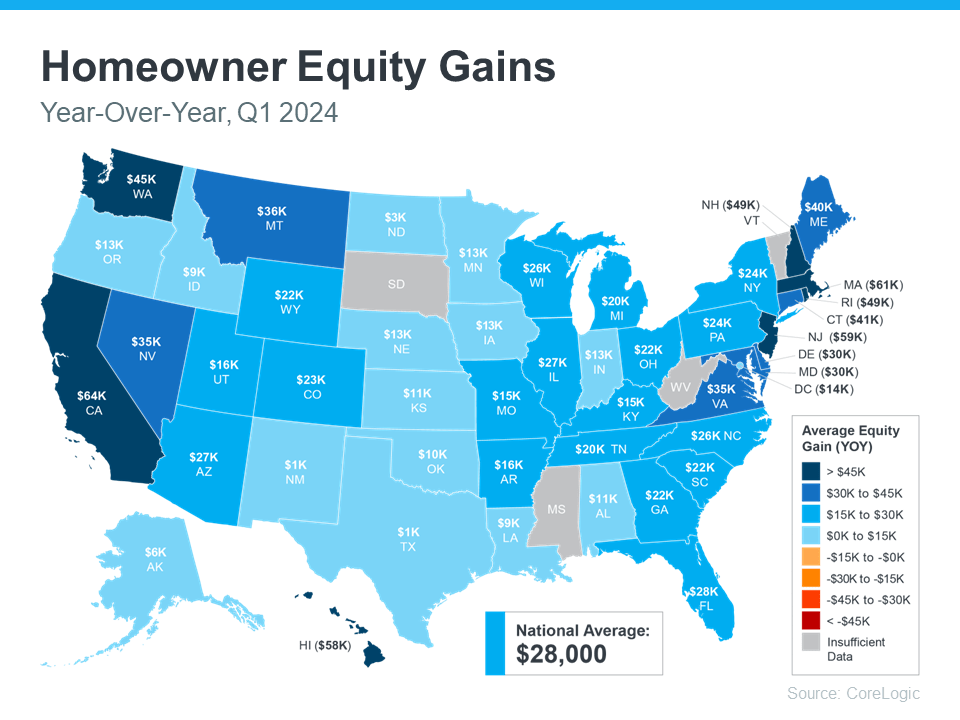

According to the latest Homeowner Equity Insights from CoreLogic, the average homeowner’s equity has jumped by $28,000 in just the past year. That’s a nationwide average, so check out the map below to see the specifics for your state. You’ll notice that every state with enough data has seen annual equity gains.

Bought Your Home Before the Pandemic?

If you purchased your home before the pandemic, you’re in for even better news. Realtor.com reports that home prices have surged by 37.5% from May 2019 to May 2024. Ralph McLaughlin, Senior Economist at Realtor.com, says:

“Homeowners have seen extraordinary gains in home equity over the past five years.”

Selma Hepp, Chief Economist at CoreLogic, adds:

“With home prices continuing to reach new highs, owners are also seeing their equity approach the historic peaks of 2023, close to a total of $305,000 per owner.”

How Can Your Rising Home Equity Help You?

With the significant equity build-up from rising home prices, you’ve got some serious benefits. You could use it to start a business, fund an education, or even help afford your next home. When you sell, the equity you’ve built comes back to you, potentially covering a big part – or even all – of your next home’s down payment.

Bottom Line

Thinking about moving? The equity you’ve gained can be a huge help. Curious about how much you have and how you can use it for your next home? Let’s connect and explore your options!