As we head into the latter half of 2024, here’s a quick rundown on what the experts are predicting for home prices, mortgage rates, and home sales.

Home Prices: A Steady Climb

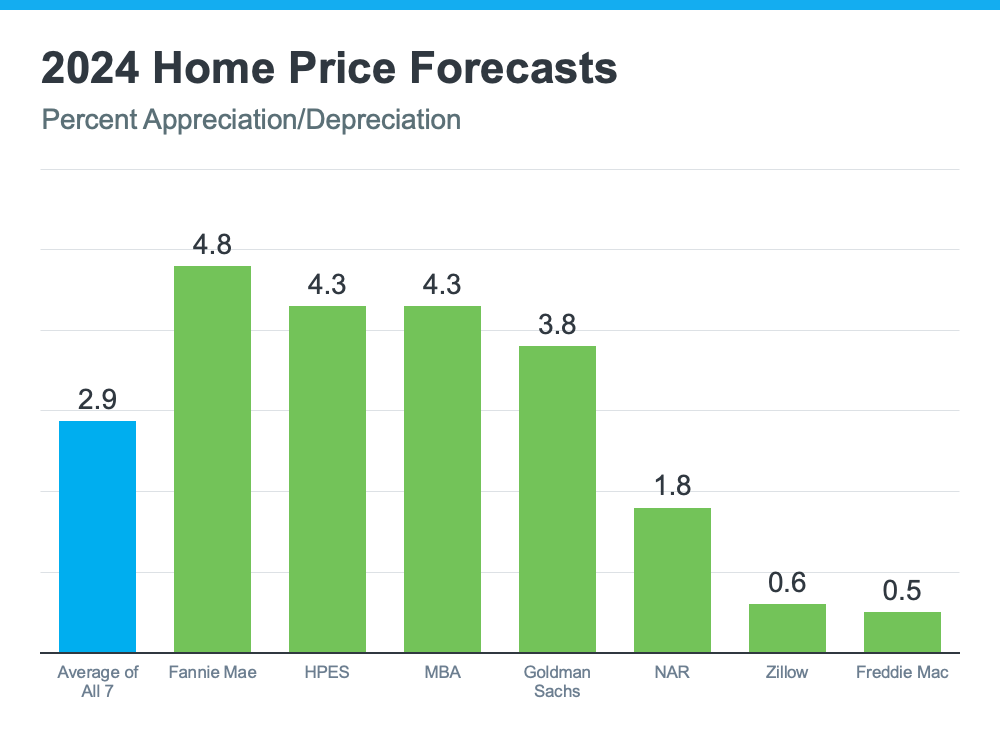

Home prices are expected to rise at a more normal pace compared to the wild spikes we’ve seen in recent years. Check out the latest forecasts from seven reliable industry sources:

The main reason for this continued appreciation? The tight supply of homes on the market. Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), puts it simply:

“One thing that seems to be pretty solid is that home prices are going to continue to go up, and the reason is that we don’t have housing inventory.”

Even though there’s more inventory now than in the past couple of years, it’s still not enough. This shortage will keep pushing prices up.

If you’re thinking about buying, the silver lining is that prices won’t skyrocket like they did during the pandemic. They’ll keep rising, but at a more manageable rate. So, getting in now might save you some cash down the road. Plus, it’s reassuring to know that experts believe your home’s value will keep growing after you buy it.

Mortgage Rates: A Slight Dip

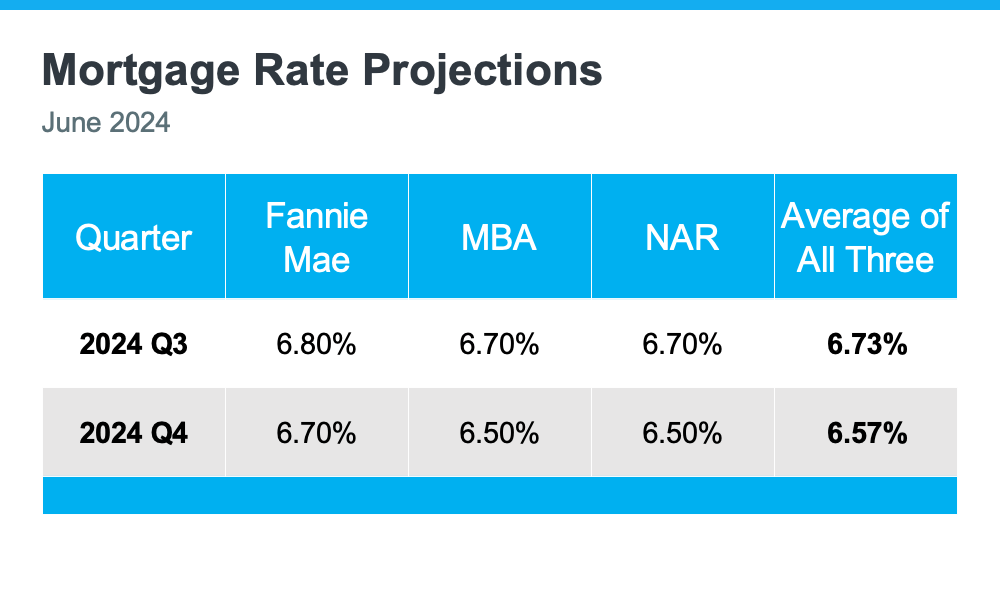

Here’s some good news for both buyers and sellers: mortgage rates are expected to drop a bit. According to Fannie Mae, the Mortgage Bankers Association (MBA), and NAR:

Even a small decrease in mortgage rates can significantly lower your monthly payments. For sellers, lower rates can attract more buyers, helping you sell faster and possibly at a better price. If you’ve been on the fence about selling because of high rates, this might just be the push you need.

Home Sales: Holding Steady

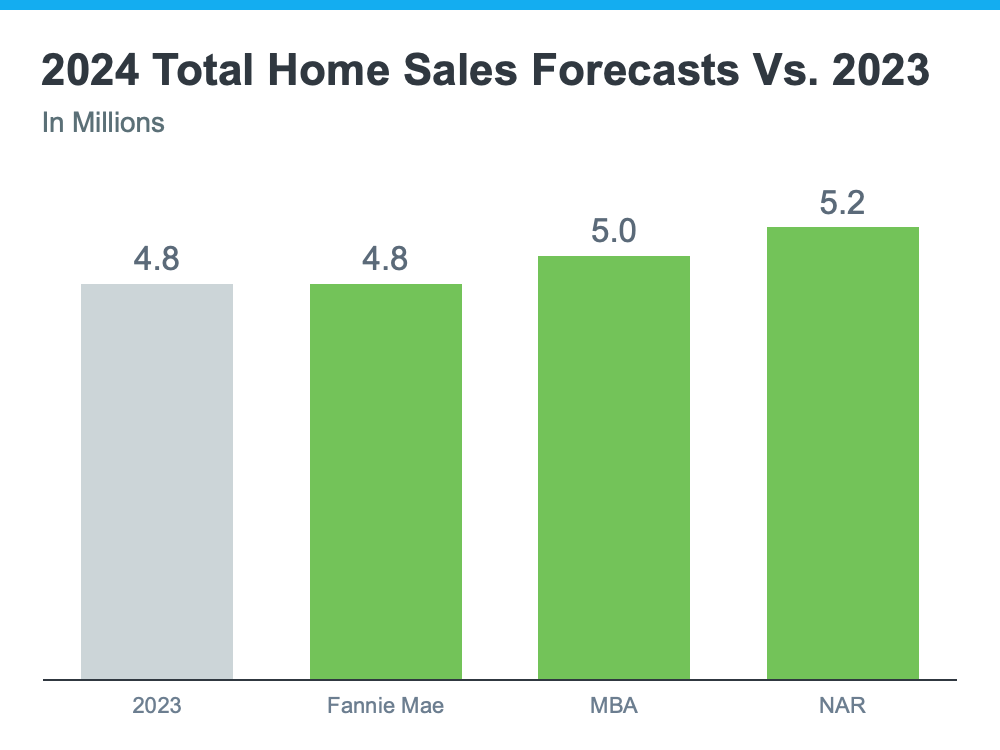

In 2024, home sales are expected to be similar to last year, with a slight potential increase. Here’s a comparison of the 2024 home sales forecasts from Fannie Mae, MBA, and NAR to the 4.8 million homes sold last year:

On average, the forecasts predict about 5 million sales in 2024, a modest rise from 2023. Lawrence Yun, Chief Economist at NAR, explains why:

“Job gains, steady mortgage rates and the release of inventory from pent-up home sellers will lead to more sales.”

With more inventory available and mortgage rates set to dip, we might see a few more homes changing hands this year. This means more opportunities for people to move, and we can work together to make sure you’re one of them.

Bottom Line

Got questions or need help navigating the market? Reach out anytime!