Thinking about moving this year? You’re probably curious about where home prices and mortgage rates are headed. Is now the right time, or should you wait it out? Here’s the lowdown from the experts to help you figure it out.

Home Prices: What’s on the Horizon?

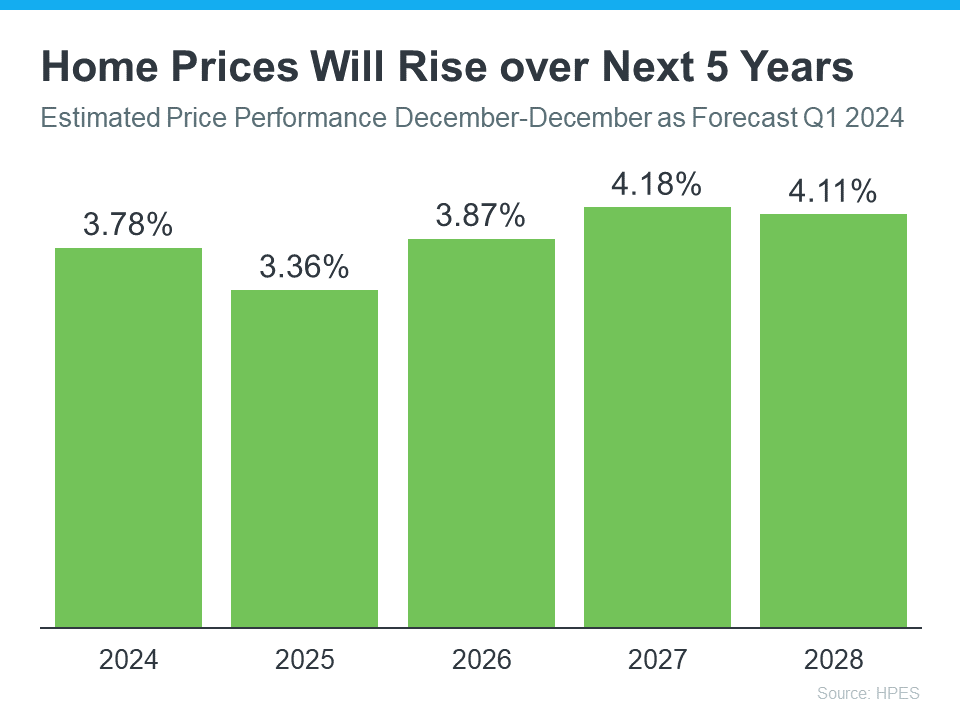

When it comes to predicting home prices, the Home Price Expectations Survey from Fannie Mae is a go-to resource. This survey collects insights from over 100 economists, real estate experts, and market strategists.

Their latest update suggests that home prices will keep climbing at least through 2028. Sure, the rate of appreciation will fluctuate from year to year, but overall, prices are set to rise at a more typical pace.

So, what does this mean for you? If you buy now, your home’s value is likely to increase, building your equity over time. If you wait, and prices keep going up, you might end up paying more for the same home later on.

Mortgage Rates: When Will They Drop?

This is the big question on everyone’s mind. Unfortunately, there’s no simple answer because mortgage rates are influenced by a mix of factors. Odeta Kushi, Deputy Chief Economist at First American, breaks it down:

“Every month brings a new set of inflation and labor data that can influence the direction of mortgage rates. Ongoing inflation deceleration, a slowing economy and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates.”

In short, the future of mortgage rates depends on how these factors play out. Experts are cautiously optimistic that rates will drop later this year, but they acknowledge that economic changes will continue to have an impact. As a CNET article notes:

“Though mortgage rates could still go down later in the year, housing market predictions change regularly in response to economic data, geopolitical events and more.”

If you’re ready and able to buy a home now, it’s a smart move to consult with a trusted real estate advisor. They can help you navigate your options and make the best decision for your situation.

Bottom Line

Let’s connect to make sure you’re up-to-date on the latest trends in home prices and mortgage rates. Together, we can review what the experts are saying and help you make an informed decision about your move.