So, you might’ve caught wind that mortgage rates are set to hang around a bit higher than folks originally thought. Wondering why? Well, it all boils down to the latest economic buzz. Here’s the lowdown on what’s up with mortgage rates and what the experts are saying.

When it comes to mortgage rates, a bunch of factors come into play – like the job market, inflation pace, consumer spending, and even geopolitical stuff. Plus, there’s the Federal Reserve, or the Fed, and their money moves. That’s the hot topic right now.

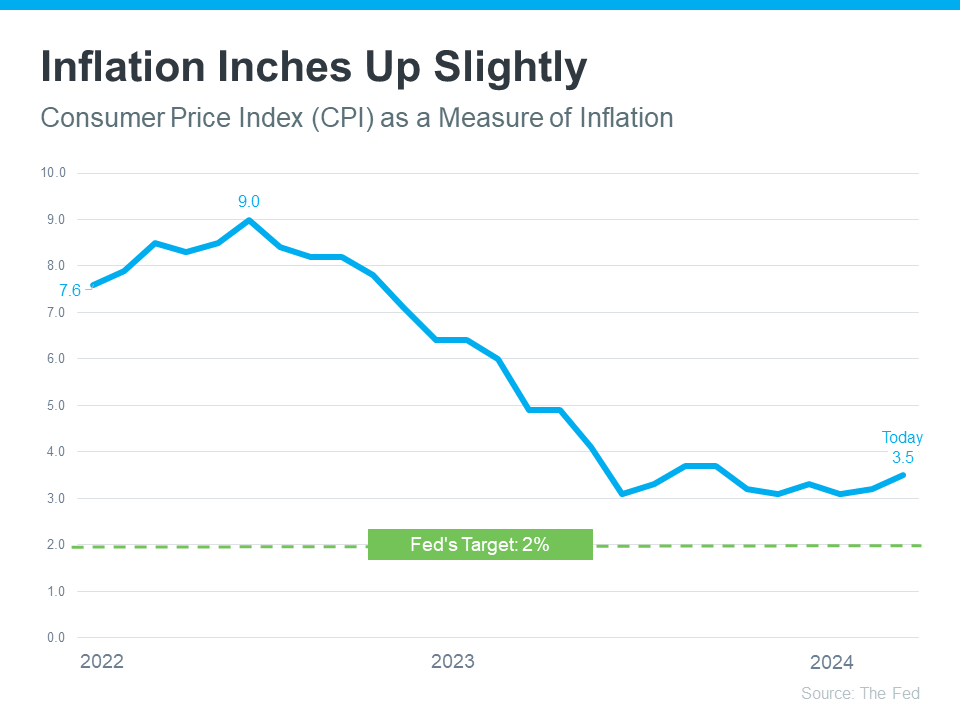

See, the Fed decided to start bumping up the Federal Funds Rate to keep the economy (and inflation) in check back in early 2022. While this rate doesn’t directly decide mortgage rates, they do tend to follow suit. And that’s when we started seeing those mortgage rates creeping up.

Now, we’ve made some progress in taming inflation since then, but we’re not quite at the Fed’s target of 2% yet. It’s been nudging up a bit over the past few months, which is making the Fed rethink their game plan. As Sam Khater from Freddie Mac puts it:

“Strong incoming economic and inflation data has caused the market to re-evaluate the path of monetary policy, leading to higher mortgage rates.”

So, in short, inflation’s the name of the game here, and it’s going to steer the ship going forward. According to Greg McBride at Bankrate:

“It’s the longer-term outlook for economic growth and inflation that have the greatest bearing on the level and direction of mortgage rates. Inflation, inflation, inflation — that’s really the hub on the wheel.”

As for when mortgage rates will take a dip? Well, experts reckon we’ll see some relief once inflation gets back in line, and the Fed might ease up on the Federal Funds Rate later this year – just not as soon as we thought. Mike Fratantoni from the MBA mentioned:

“The FOMC did not change the federal funds target at its May meeting, as incoming data regarding the strength of the economy and stubbornly high inflation have resulted in a shift in the timing of a first rate cut. We expect mortgage rates to drop later this year, but not as far or as fast as we previously had predicted.”

So, long story short, mortgage rates should ease up eventually, but there’s a lot that could shake things up along the way. That’s why trying to time the market isn’t usually the best bet, as Bankrate suggests:

“ . . . trying to time the market is generally a bad idea. If buying a house is the right move for you now, don’t stress about trends or economic outlooks.”

Got questions about the housing scene? Let’s chat.