So, you might have caught wind of those news stories lately claiming it’s cheaper to rent than to buy a place. And sure, when you glance at the monthly bills, renting might seem lighter on the wallet. But hold up, there’s a key factor these headlines often overlook: home equity. Let’s break down why it’s a game-changer in your decision-making process.

What the Buzz Is All About

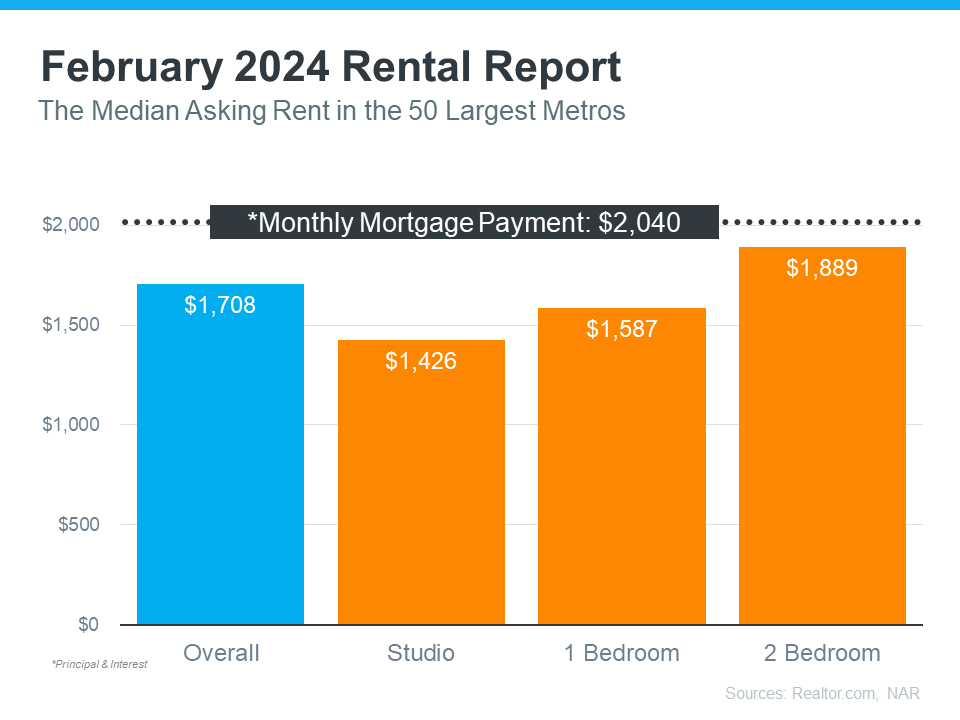

So, there’s this graph floating around, comparing the national median rent to the median mortgage payment. It shows that, especially if you’re not craving acres of space, renting can be easier on your wallet each month:

But if you’re eyeing a cozy 2-bedroom spot, the gap between rent and mortgage payments starts to shrink. The median monthly mortgage payment rings in at $2,040, while a 2-bedroom rent averages $1,889. That’s a difference of about $151 monthly. But hold onto your hat, because here’s where equity comes into play.

The Equity Effect

Renting means your monthly cash is solely covering your living expenses and lining your landlord’s pockets. Sure, you might save a few bucks monthly and potentially snag your deposit back when you move out, but that’s about it – the money you shell out for rent vanishes into the ether.

But when you buy, your mortgage payments aren’t just expenses; they’re investments. With each payment, you’re chipping away at what you owe on your home loan, building equity in the process. Plus, as home values generally trend upward, your equity gets a nice boost.

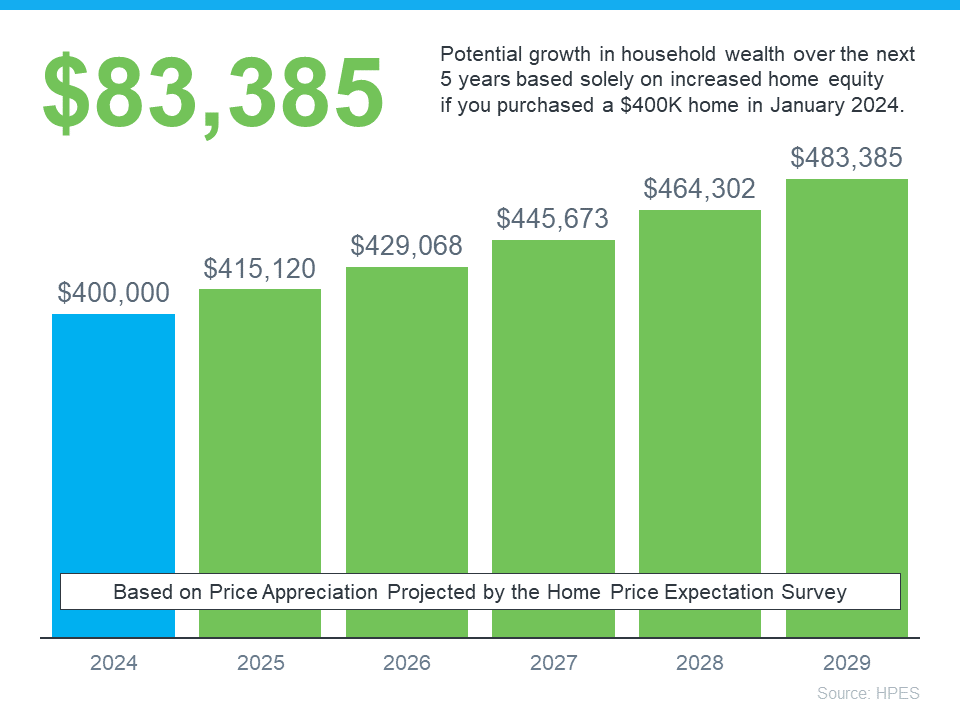

Let’s put it in perspective with some data. Every quarter, Fannie Mae and Pulsenomics tap into the Home Price Expectations Survey, polling over 100 experts about where they see home prices headed. Spoiler alert: they’re forecasting a continued climb.

Check out this hypothetical scenario based on those projections:

Say you snagged a $400,000 home earlier this year and plan to stick around for a while. According to the experts, if you hang tight for 5 years, you could be sitting on over $83,000 in added wealth as your home appreciates.

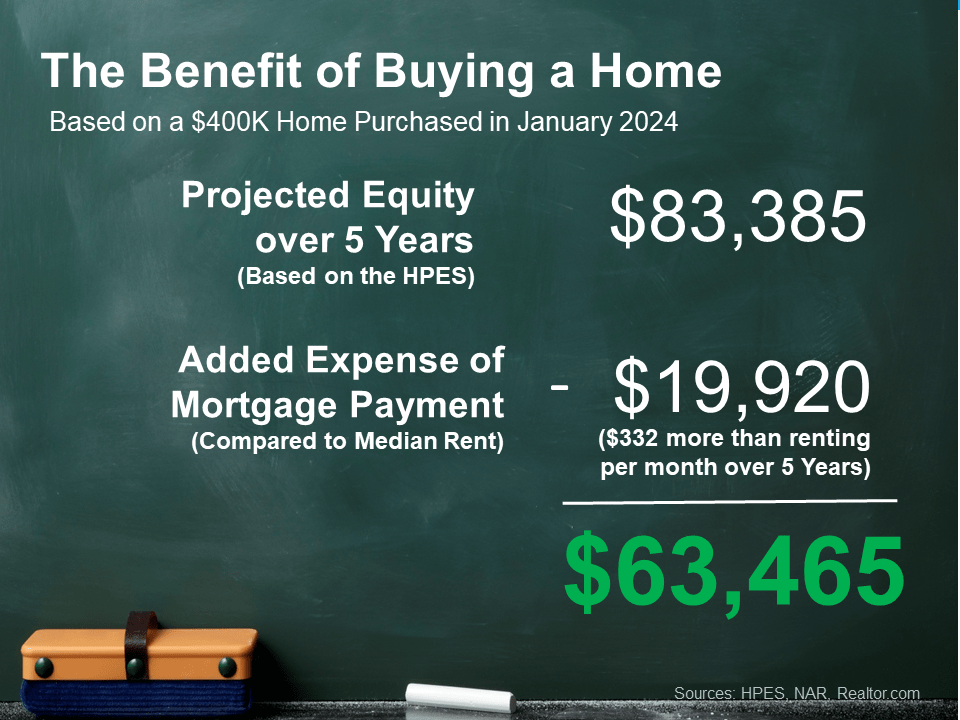

Now, let’s compare that to renting, using the median rent we talked about:

Sure, renting might shave a bit off your monthly expenses, but you’re missing out on the equity gains.

So, what’s the bottom line? Whether buying or renting makes more sense depends on your financial situation. If the numbers don’t add up, buying might not be the move. But if you’re in a position to do so, factoring in equity could tilt the scales toward buying for the long haul.

In a nutshell, buying a home offers something renting just can’t match – the chance to build equity. If you’re keen on riding the wave of long-term home value appreciation, let’s chat about your options.