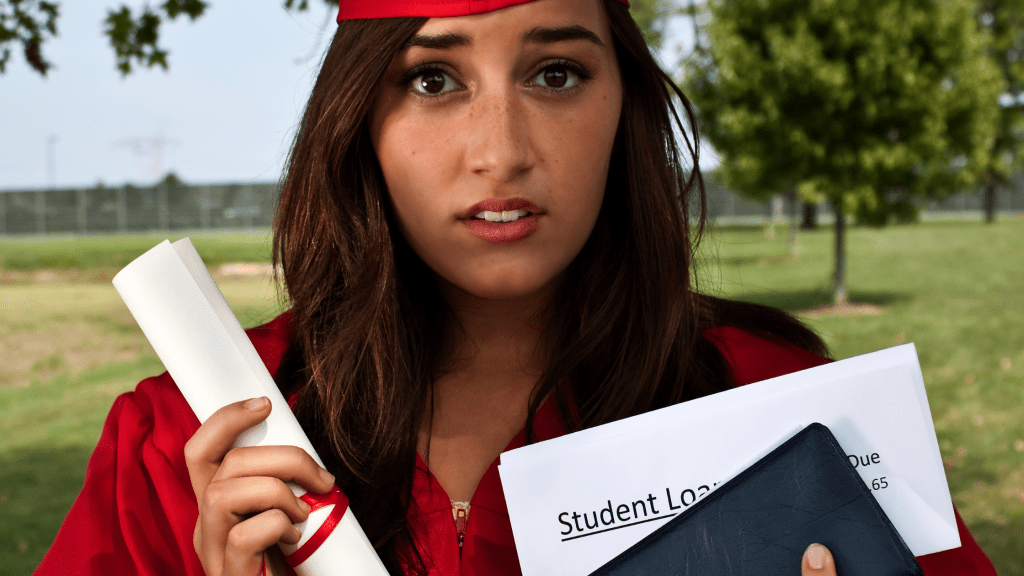

Got student loans and eyeing that dream home? Wondering if your debt is the ultimate dream crusher? Well, hold your horses and let’s clear the air.

So, you’re thinking, “Do I have to ditch my student loans before I can even think of home sweet home?” Nah, not necessarily. Sure, those loans can feel like a weight strapped to your back, but buying a house might still be on the cards.

Check this out: A Bankrate piece spilled the beans that around 60% of adults in the US with student debt have hit the brakes on big money moves because of it. Yep, that includes biggies like buying a house. But here’s the kicker — you might not have to wait it out.

Ever wondered if you can snag a mortgage while still battling those student loans? Well, you’re not alone. According to the National Association of Realtors, a solid chunk of first-time homebuyers, about 38%, are toting student loan baggage, with the average amount hovering around 30 grand. So, yes, it’s doable.

Turns out, you can juggle student loans and a mortgage at the same time. Who knew? Bankrate points out that there are loads of home loan programs that might just cut you some slack, even if you’re swimming in student debt.

Long story short, buying a house with student loans in tow isn’t just a pipe dream. Don’t sweat it solo, though. Talk to a lender who knows their stuff. They can lay out your options and dish the deets on what’s worked for others.

In a nutshell, owning your own slice of real estate isn’t just reserved for the student loan-free elite. Chat with a lender, weigh your options, and who knows, you might be closer to unlocking that front door than you think.