Hey there, if you’ve been mulling over the idea of buying a home, you’ve probably got mortgage rates on your mind. Maybe they’re the reason you’ve hit pause on your plans for now. Last year, when rates crept up to around 8%, it threw a curveball for some folks, making the numbers not quite add up for their budget anymore. Sound familiar?

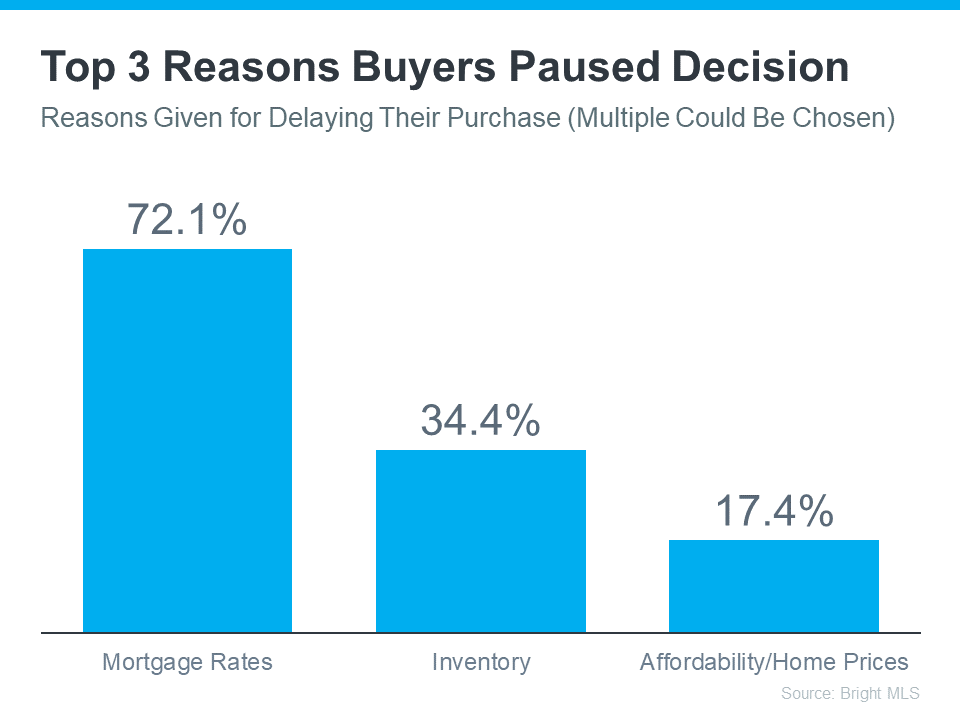

According to data from Bright MLS, high mortgage rates were the main reason why many buyers hit the brakes on moving forward (check out the graph below).

David Childers, CEO at Keeping Current Matters, chimed in on this trend in a recent How’s The Market podcast, saying, “Three quarters of buyers said ‘we’re out’ due to mortgage rates. Here’s what I know going forward. That will change in 2024.”

Why the optimism? Well, mortgage rates have eased off their peak from last October. And while they still bounce around day to day, the big picture suggests they should keep on dropping this year, especially if we can rein in inflation. Some experts are even predicting rates dipping below 6% by the end of 2024. Now, that’d be a gamechanger for many buyers.

As a recent article from Realtor.com puts it, “Buying a home is still desired and sought after, but many people are looking for mortgage rates to come down in order to achieve it. Four out of 10 Americans looking to buy a home in the next 12 months would consider it possible if rates drop below 6%.”

Now, while forecasting mortgage rates is a bit like predicting the weather, the upbeat outlook from the experts should give you some hope. If your plans got shelved, there’s a glimmer of hope again. So, maybe it’s time to dust off those plans. The big question now is:

What’s the magic number for you when it comes to rates before you’re ready to jump back in?

That magic number is different for everyone. Maybe it’s 6.5%. Perhaps it’s 6.25%. Or maybe it’s once they dip below 6%.

Once you’ve got that number locked in, here’s the game plan: Reach out to a local real estate pro. They’ll keep you in the loop on what’s happening. And as soon as rates hit your target, they’ll be ringing your phone.

In a nutshell, if mortgage rates have put your moving plans on ice, it’s worth considering the number that would make you ready to dive back in.

Once you’ve got that number locked and loaded, let’s connect. You’ll have someone in your corner, ready to give you the heads up when we hit that sweet spot.