Hey there!

Let’s cut through the noise and get to what really matters in the mortgage market right now. If you’ve been feeling a bit dizzy with all the ups and downs, take a breath because here’s the scoop: compared to last year’s peak of nearly 8%, mortgage rates have been on a steady downward trend.

And if you’re in the market to buy or sell a home, this is pretty exciting stuff. Yes, rates will continue to dance around a bit due to various economic factors like inflation and the consumer price index, but the experts are in agreement that we’re looking at a continued downward trajectory for this year.

Sure, we may not be revisiting those rock-bottom rates from the pandemic era, but some smart minds out there are predicting that we could see rates dipping below 6% later this year. Dean Baker, Senior Economist at the Center for Economic Research, puts it like this:

“They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

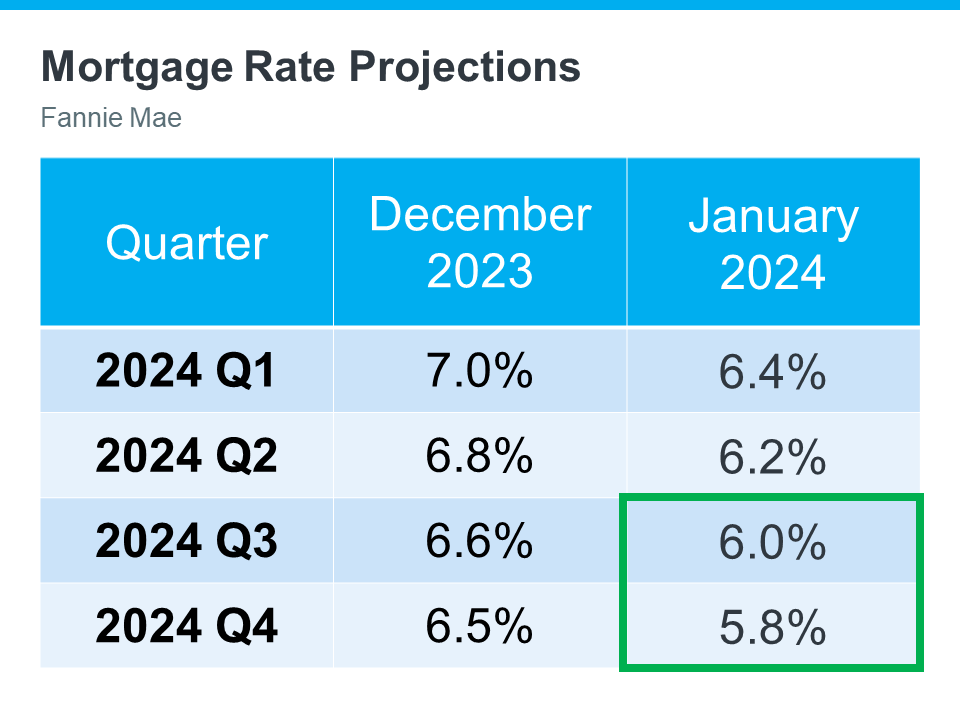

And he’s not alone in this forecast. The latest projections from Fannie Mae also suggest a possible sub-6% rate by the end of this year (check out the green box in the graph below):

Notice the trend? The line is pointing down, folks!

Of course, these are just projections, and the market can be a bit unpredictable, especially in the short term. But here’s the takeaway: don’t let the day-to-day fluctuations scare you. Keep your eye on the bigger picture.

If you’ve found your dream home in today’s market, consider making your move now. Waiting for rates to drop even further might not be the best strategy, especially when rates are already lower than they were last fall. Even a small drop in rates can give your buying power a boost.

So, if you’ve been itching to make a move, this could be your moment. Let’s chat and see how we can make it happen.