Owning a home is a big part of the American Dream, but getting there isn’t always straightforward. Despite progress in fair housing access, households of color still encounter unique hurdles on the journey to homeownership. That’s where the right real estate experts come in, making all the difference for diverse buyers.

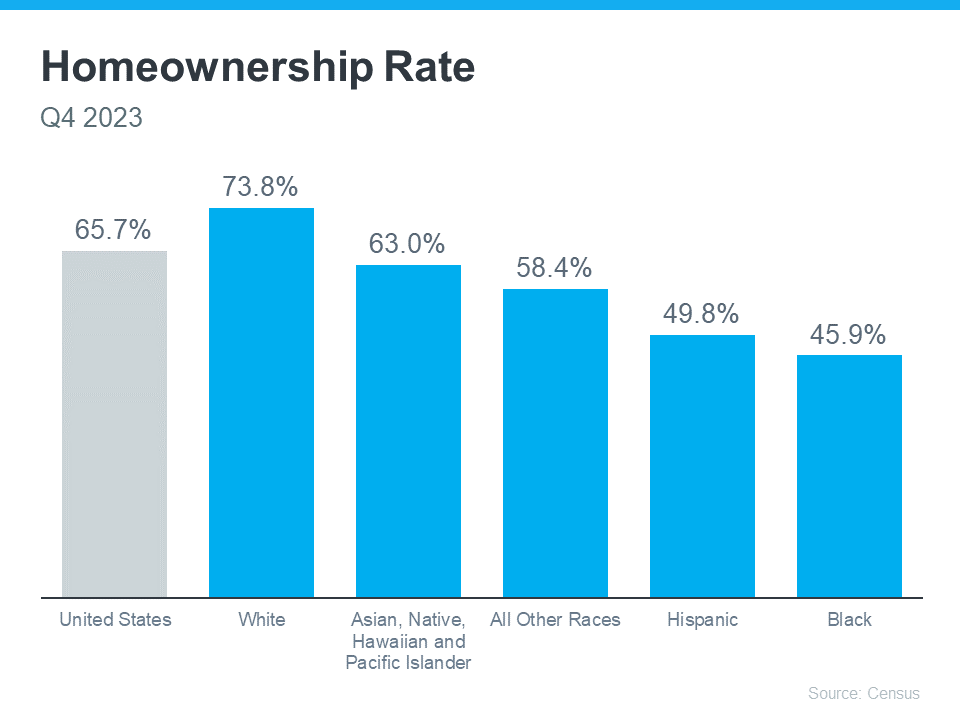

It’s evident that certain groups face greater challenges in achieving homeownership, as there’s still a noticeable gap between the overall U.S. homeownership rate and that of non-white groups. Notably, Black households have the lowest homeownership rate nationally.

Homeownership is a crucial aspect of building household wealth, yet many Black homebuyers in 2023 were first-time buyers, lacking home equity for their purchase. This financial barrier adds complexity, particularly in today’s concerningly unaffordable market, as highlighted by Jessica Lautz, Deputy Chief Economist at NAR.

To address these challenges, various down payment assistance programs specifically target minority buyers, such as the 3By30 program for Black buyers, Down Payment Resource for Native Americans, and Fannie Mae for first-time homebuyers in Latino communities. Even if these programs aren’t suitable, there are numerous federal, state, and local options to explore, with real estate professionals available to help find the best fit.

For minority homebuyers, the remaining challenges can be painful and frustrating. This emphasizes the importance of having a supportive team of experts throughout the homebuying process. These professionals not only offer market expertise and sound advice but also serve as compassionate advocates for your best interests.

Bottom Line

Let’s connect to ensure you have the information and support needed as you pursue homeownership.