Hey there, have you caught wind of those alarming headlines swirling around about a surge in foreclosures lately? It’s totally understandable if they’ve left you feeling a tad uneasy about what’s on the horizon. But let’s take a breather and dive a bit deeper into what’s really going on, shall we?

Here’s the scoop: those sensational clickbait titles often paint an exaggerated picture, only showing part of the story. The truth? When we compare the current numbers to the broader historical trends, there’s actually not much cause for concern.

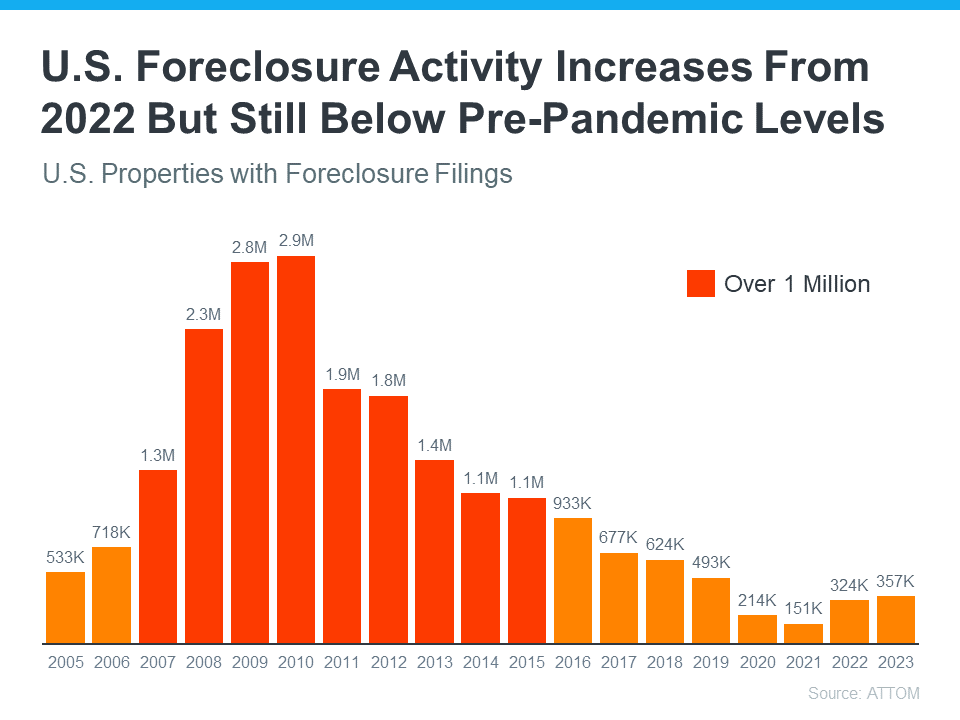

Sure, there’s been a bit of a bump in foreclosure activity recently. But here’s the kicker: these reports tend to overlook the fact that we’re still nowhere near the levels seen during the housing crash of 2008. In fact, we’re not even back to the more typical figures we saw in 2019.

Why the difference? Well, today’s buyers are generally more financially savvy and less likely to default on their mortgages. Plus, most homeowners have built up enough equity to weather any storms without facing foreclosure.

Now, let’s talk numbers. While it’s true that foreclosures are on the rise, it’s important to note that they’re still only at about 60% of pre-pandemic levels. And when we look at mortgage delinquency rates, they’re remaining healthy, with serious delinquency rates staying at historic lows.

So, while it’s true that foreclosures are on the rise, it’s far from the doomsday scenario some headlines might suggest. If you’re feeling uncertain or want to dive even deeper into what’s happening in the housing market, I’m here to provide clarity and guidance. Let’s connect and chat!