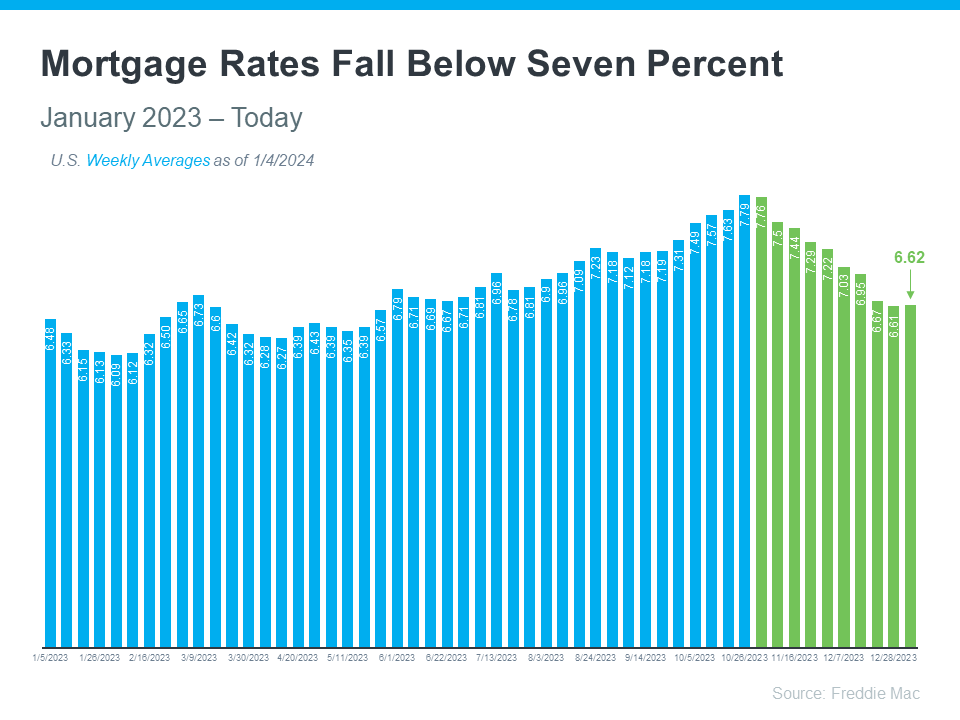

Hey future homeowners! Exciting news – lower mortgage rates are making waves, and it’s the perfect time to dive into that dream home journey. So, what’s the scoop? Rates for 30-year fixed mortgages are taking a dip, currently hanging out below the 7% mark. According to our pals at Freddie Mac, it’s a golden opportunity for buyers like you:

Bankrate spilled the beans in a recent article, mentioning how the rate cool-off is easing the housing affordability squeeze. Edward Seiler from the Mortgage Bankers Association chimes in, saying MBA expects affordability conditions to keep getting better as mortgage rates take a dip.

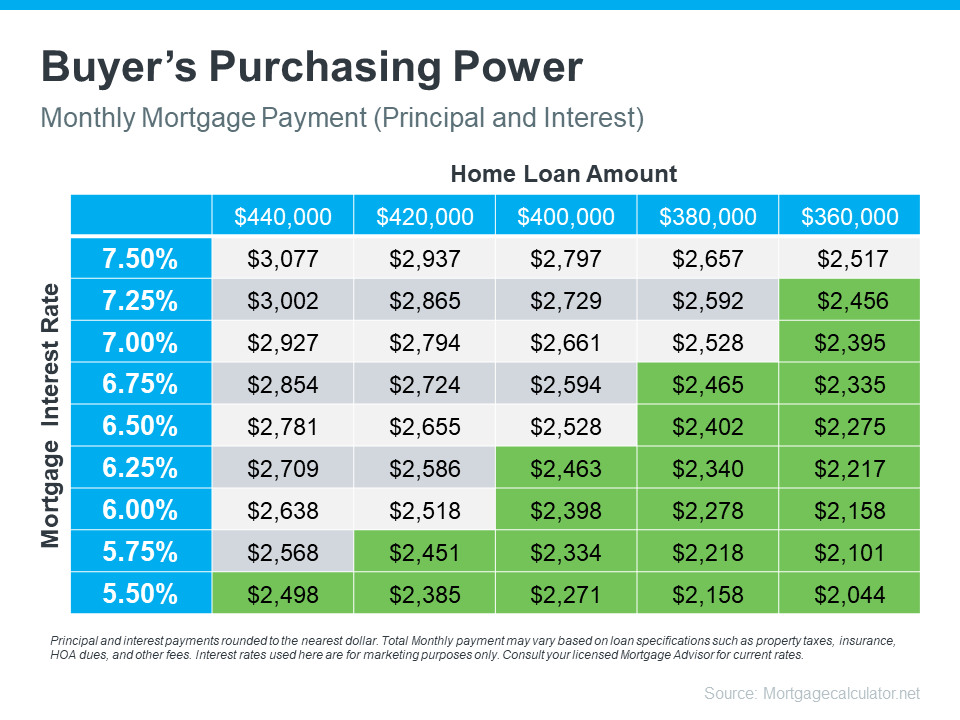

Now, let’s break it down a bit. Ever wondered how these rates play with your home-buying budget? Check out the chart below:

Even small rate changes can shake things up. Imagine having a monthly budget between $2,400 and $2,500 – that green zone in the chart is where you want to set up camp.

Feeling a bit lost in the mortgage maze? No sweat! Connect with a local real estate agent (AKA Me!) and a trusted lender. They’re like your home-buying gurus, ready to guide you through different mortgage options, unravel the mysteries of rates, and help you make sense of the numbers. By staying in the loop and adjusting your strategy with today’s rates, you’ll be all set to make that dream home yours.

So, if you’re gearing up to make a move, this downward trend in mortgage rates is like a green light for your home-buying journey. Ready to dive in? Let’s have a chat and plan those exciting next steps!