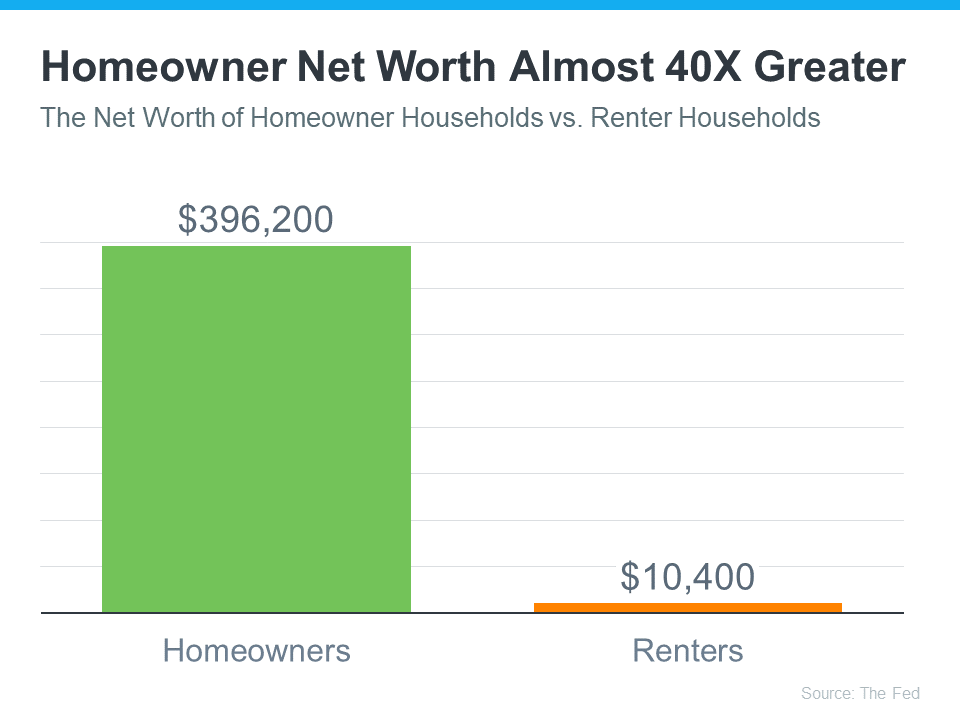

Thinking about whether to rent or buy a home this year? Let me drop some cool insights that might help you decide. So, the Federal Reserve does a survey every three years, and their latest scoop is mind-blowing. If you’re a homeowner, your net worth is like 40 times more than someone renting. No joke, check out this graph:

Now, why the big gap? Homeowners hit the jackpot because as their house gains value and they keep up with those mortgage payments, their equity starts doing a happy dance. It’s like a secret savings account that pays off when you decide to cash in. Renters, unfortunately, miss out on this money magic. Ksenia Potapov, Economist at First American, puts it simply:

“Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated by monthly mortgage payments . . .”

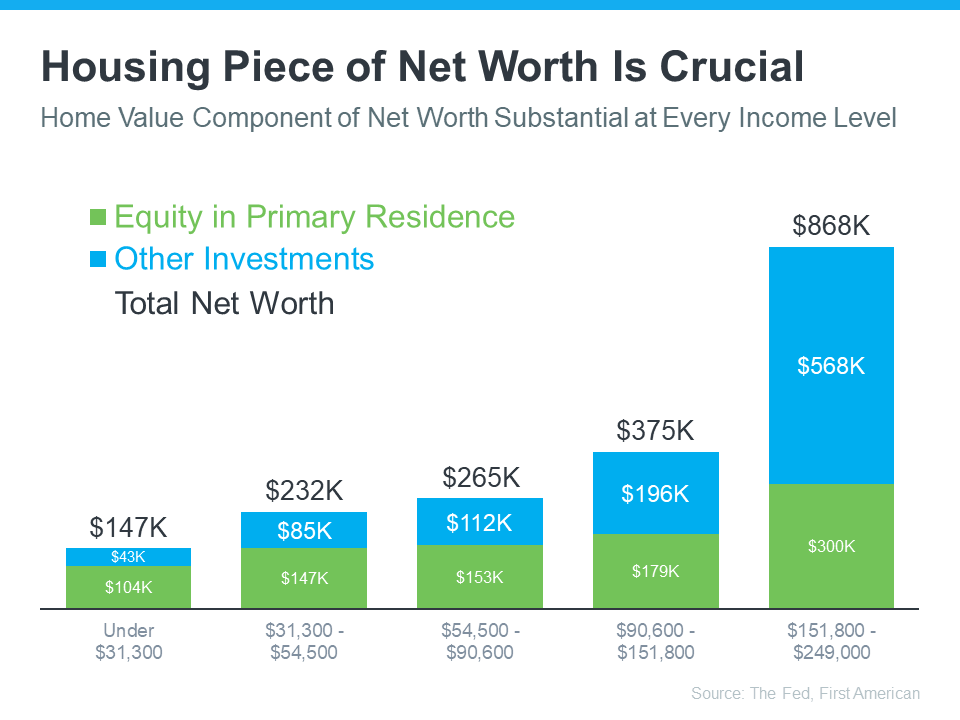

Now, let’s talk about the real hero – home equity! It’s the boss, no matter your paycheck. Check out this other graph:

Nicole Bachaud, the Senior Economist at Zillow, drops some wisdom:

“The biggest asset most people are ever going to own is a home. Homeownership is really that financial key that helps unlock stability and wealth preservation across generations.”

Feeling the itch to level up your net worth? Good news! The real estate market is serving up some sweet deals. Mortgage rates are doing a limbo, going lower, and there’s a buffet of homes for you to check out. And hey, a local real estate agent (like me!) can be your guide through this maze, helping you find that dream home.

To sum it up, whether you’re rolling in dough or keeping it real on the budget, owning a home can be your golden ticket to long-term wealth. Got questions or just want to shoot the breeze about homeownership? Let’s connect!