Contemplating the sale of your house? The current mortgage rates might be causing hesitation about the decision. Some homeowners are reluctant to sell and take on a higher mortgage rate for their next home. If you share this concern, it’s essential to recognize that despite the current high rates, home equity is also on the rise. Here’s what you should understand.

Bankrate provides a clear definition of equity and its growth:

“Home equity is the portion of your home that you’ve paid off and own outright. It’s the difference between the home’s current value and the remaining balance on your mortgage. As your home’s value increases over time and you reduce the principal on the mortgage, your equity stake expands.”

In simpler terms, equity is the current value of your home minus the outstanding mortgage balance.

What is the Current Home Equity for Homeowners?

Recently, home equity has been accumulating at a faster pace than expected. To put the average homeowner’s equity into perspective, CoreLogic states:

“…the average U.S. homeowner now has about $290,000 in equity.”

This growth is attributed to significant increases in home prices over the past few years, which accelerated the accumulation of equity. While the market is beginning to stabilize, the demand for homes still surpasses the available supply, leading to another surge in home prices.

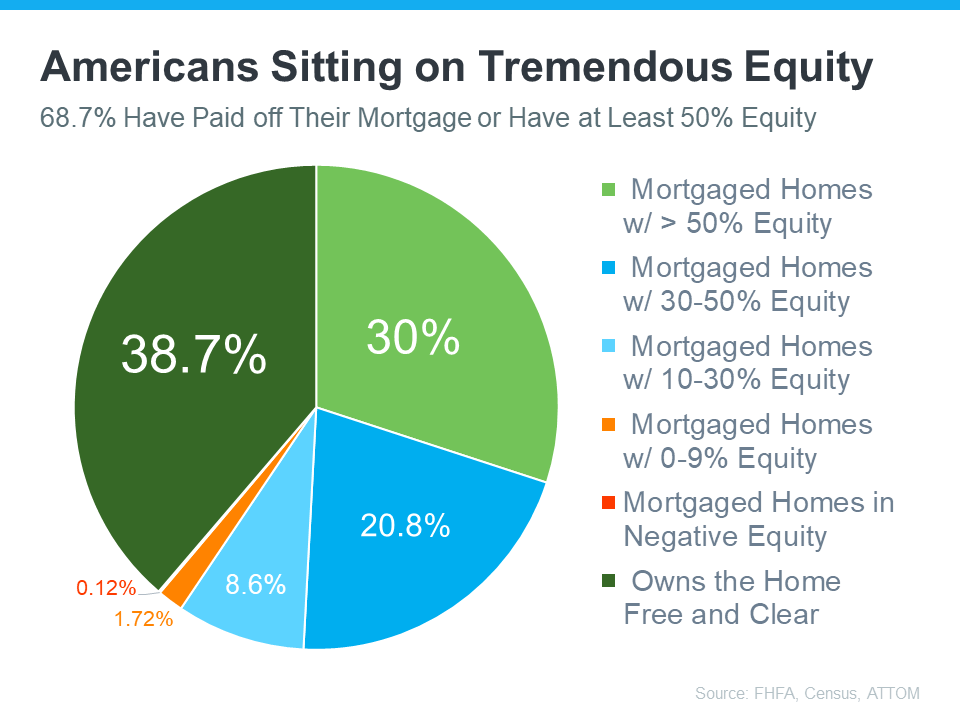

As per data from the Federal Housing Finance Agency (FHFA), the Census, and ATTOM, a provider of property data, almost 68.7% of homeowners have either completely paid off their mortgages or possess a minimum of 50% equity (refer to the chart below):

That means nearly 70% of homeowners have a tremendous amount of equity right now.

How Equity Addresses Affordability Challenges

In the face of current affordability issues, your accumulated equity can significantly impact your decision to relocate. Once you sell your property, the equity you’ve established in your home can be a valuable asset in acquiring your next one. Here’s how it can be beneficial:

Become an all-cash buyer: If you’ve resided in your current residence for an extended period, the equity you’ve amassed might enable you to purchase a new home without the need for a loan. In such cases, you can bypass borrowing money and circumvent concerns about fluctuating mortgage rates. According to the National Association of Realtors (NAR):

“These all-cash home buyers are happily avoiding the higher mortgage interest rates…”

Make a larger down payment: Your equity can be applied towards your upcoming down payment, potentially allowing you to contribute a more substantial amount. This approach reduces the necessity to borrow a significant sum, thereby mitigating the impact of current interest rates. As explained by Experian:

“Increasing your down payment lowers your principal loan amount and, consequently, your loan-to-value ratio, which could lead to a lower interest rate offer from your lender.”

In conclusion, if you’re contemplating a move, the equity you’ve accrued can be a game-changer, especially in the current environment. To assess the equity in your current property and explore how it can be utilized for your next home, let’s get in touch.